|

|

|

|

|

|

The Way of Water

By Morgan Christen

CFA, CFP, CDFA, CEO and CIO

Welcome,

When did we become so thirsty? Everywhere I look, people have water - be it a water bottle or a fancy Stanley quencher. (Quencher??) I guess we are thirsty. After doing an unscientific poll, it seems our thirst may fall along generational lines.

Before you say, "OK Boomer," I will state for the record that I am Generation X (don't get me started on the Boomers). For reference, the National Academy of Science's Food and Nutrition Board suggests adults should consume 64 ounces of water per day.

|

|

|

|

|

I drink water when I am active but am not obsessive about getting my water allotment. Growing up, I would take a sip from the garden hose if I needed a bit of water. No one told me I needed to drink more (or any?) water.

Maybe there were more water fountains in service at the time of my youth? Overall, I am a minimalist and cannot imagine carrying around one of those giant water jugs.

|

|

|

|

|

Maybe it is social media, they say that Millennials and Gen Z prefer the Apple iPhone over Samsung. Can't take the embarrassment of a green text bubble. Maybe they can't take the embarrassment of not having a bottle of water.

Is it peer pressure or statistics that suggest we drink more water? "Becky has a Stanley so I must own one, or do statistics say drinking water makes my skin look radiant?" I think it is a combination of both. We want to fit in and, at its core, water is good for you.

|

|

|

|

|

|

|

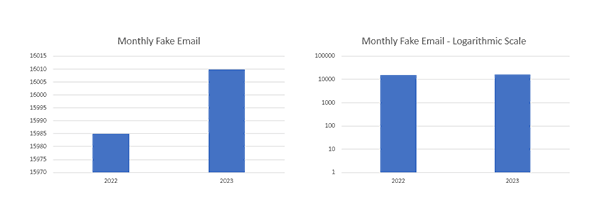

Meanwhile, the internet bombards us with information. As Abraham Lincoln once said, "not all you read on the internet is true." Take graphs, for instance. Change the scale, manipulate the Y-axis, skip numbers, and don't start with zero... make it fit your desires. Take graphs with a grain of salt. To help make this point, I created the following charts entitled "Monthly Fake Email."

The first chart entitled Monthly Fake Email visually shows a dramatic difference, even though the two bars are only 25 emails apart. Once I smooth out the second chart logarithmically, it becomes less impactful. Scale is everything.

|

|

|

|

|

|

|

|

|

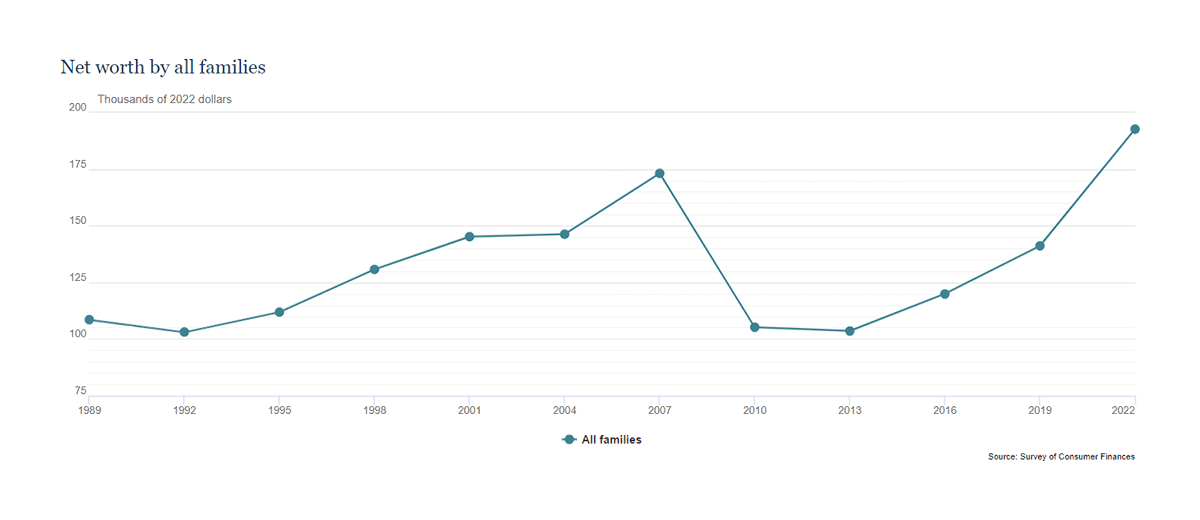

Which brings us to economic charts.

You may have heard the news about how total household net worth grew 37% over the 2019-2022-time frame. That is impressive.

When we further break down where the increase comes from, we see housing is a large component.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Those of us in California saw massive increases in the value of our homes. While this gives us a good feeling financially, our home value does not necessarily equate to spendable income.

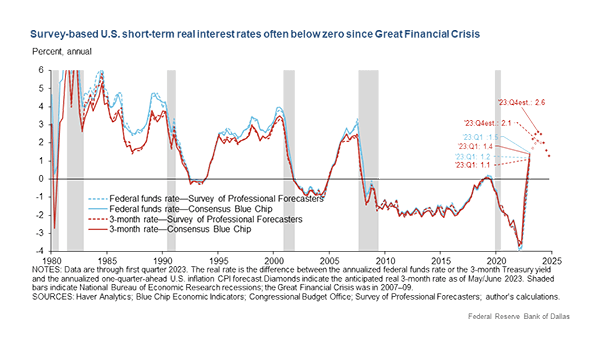

Based on the latest GDP numbers, we are still spending. But if you look at the chart that speaks to short-term real interest rates, there is a correlation with the rise in home values. Money has been essentially free since 2009, and as a result we bought bigger homes and took on larger mortgages. Who wouldn't? Free money.

In fact, for over 30 years the cost of funds has fallen, and for the last 10 years the real cost was below zero. We had a lot of forces keeping rates low, including The Fed, recovery from a real estate induced recession, not to mention China investing their trade surplus into government treasury bonds (demand up, rates down). Massive scale.

|

|

|

|

|

|

Who Wins and Who Loses?

The era of zero interest rates propped up many companies that should have been put out to pasture. The era also allowed investment in corporate pet projects along with riskier ventures... and that is ending.

The government, or should I say the American taxpayer, will see annual debt payments continue to increase.

|

|

|

|

|

|

Who Wins?

Savers, finally. The fact that you can get a fair rate of interest from bonds is wonderful.

Good companies will also fare well. Quality should see their day in the sun.

Increasing rates do have a negative impact on stocks. Generally once rates stabilize, so should stocks; especially those that are economically viable.

|

|

|

|

|

|

|

|

|

|

Flowing Forward

We all have our own unique relationship with water. It could be founded upon fear of the tap, the age of our pipes, scientific literature, or just pop culture. But it appears we are drinking more. That can't be bad.

We have (some more than others) taken the interest rate journey, and the ride is stabilizing. The scale of increases this time has been big and quick. The impacts are felt far beyond a lack of houses sold.

|

|

|

|

|

A large part of the economy, namely real estate/real estate finance is flat lining, and the patient will not recover quickly. A good amount of water could sure help flush out the system.

For investors, it's time to pay down variable debt, as rates will stay higher longer and the era of free money is gone. Save more, as rates are attractive. Own good stocks and drink your water.

Thank you for your continued support. We look forward to speaking with you.

|

|

|

|

|

Have You Taken

The SpinnCycle™?

A quick reality check for your portfolio

Enter the SpinnCycle and find your SpinnScore™

|

|

|

|

|

|

Spinnaker Mobile App now Available for IOS and Android

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2023 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Inflation is typically defined as the change in the non-seasonally adjusted, all-items Consumer Price Index (CPI) for all urban consumers. CPI data are available from the US Bureau of Labor Statistics. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. The indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice.

|

|