|

|

|

|

|

|

October Effect

By Morgan Christen

CFA, CFP, CDFA, CEO and CIO

Welcome,

October has a bad reputation in stock market participants' minds. Markets witnessed the 1907 panic, Black Tuesday in 1929 and Black Monday in 1987. These past drops caused the perceived notion that October is a bad month, hence the "October Effect."

The facts suggest otherwise, however, as the month statistically has been better than most would expect. We did come off a bad September; maybe that was because of the "September Effect" - the notion that September weakens in anticipation of a perceived weaker October. Hmmm.

|

|

|

|

|

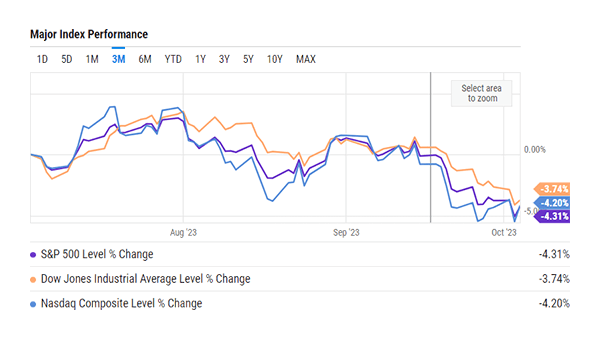

September did not disappoint in disappointing, as the start of the year rally ground to a halt in the third quarter. Yields on long term bonds soared, as any expectation of a 2023 rate-reduction was erased.

The "magnificent seven" (Apple, Alphabet, Meta, Amazon, Microsoft, Nvidia and Tesla) retreated. Those seven were the drivers of the first half rally, especially in the Nasdaq and S&P 500 indexes, as market participants flocked to AI-related names.

|

|

|

|

|

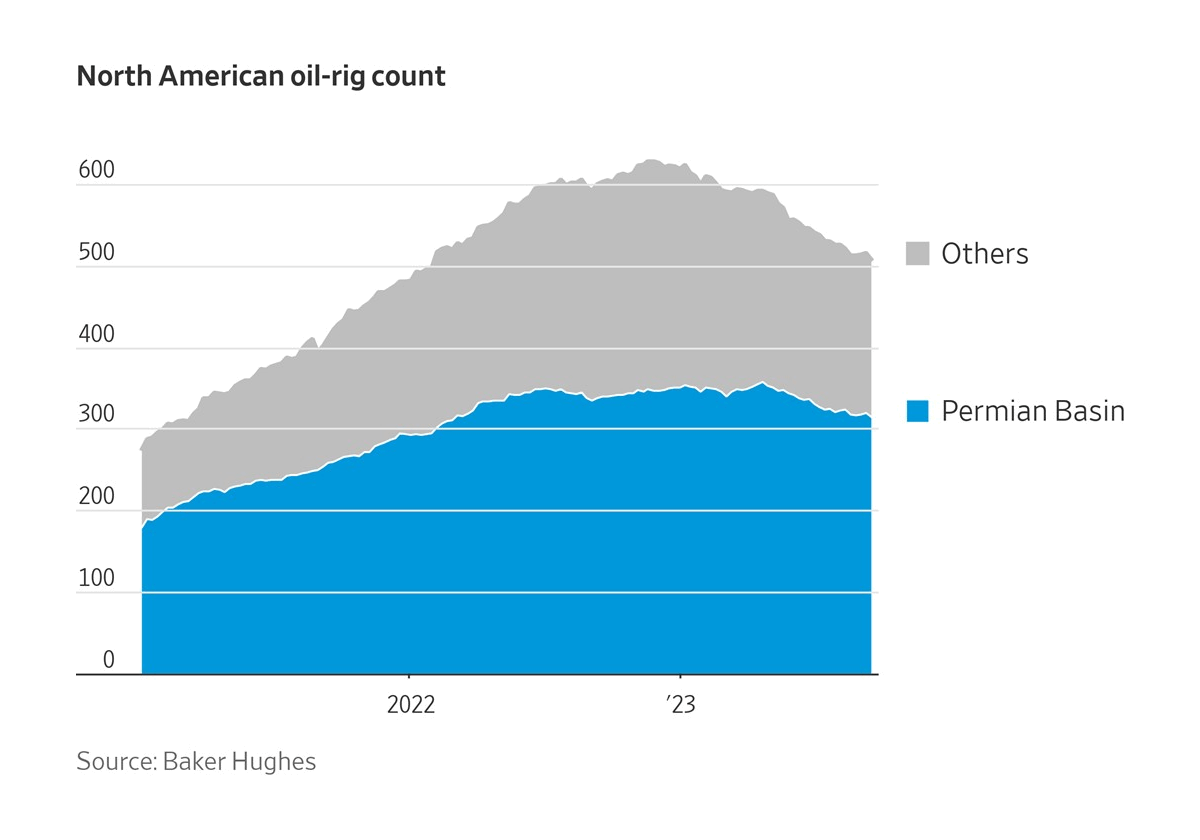

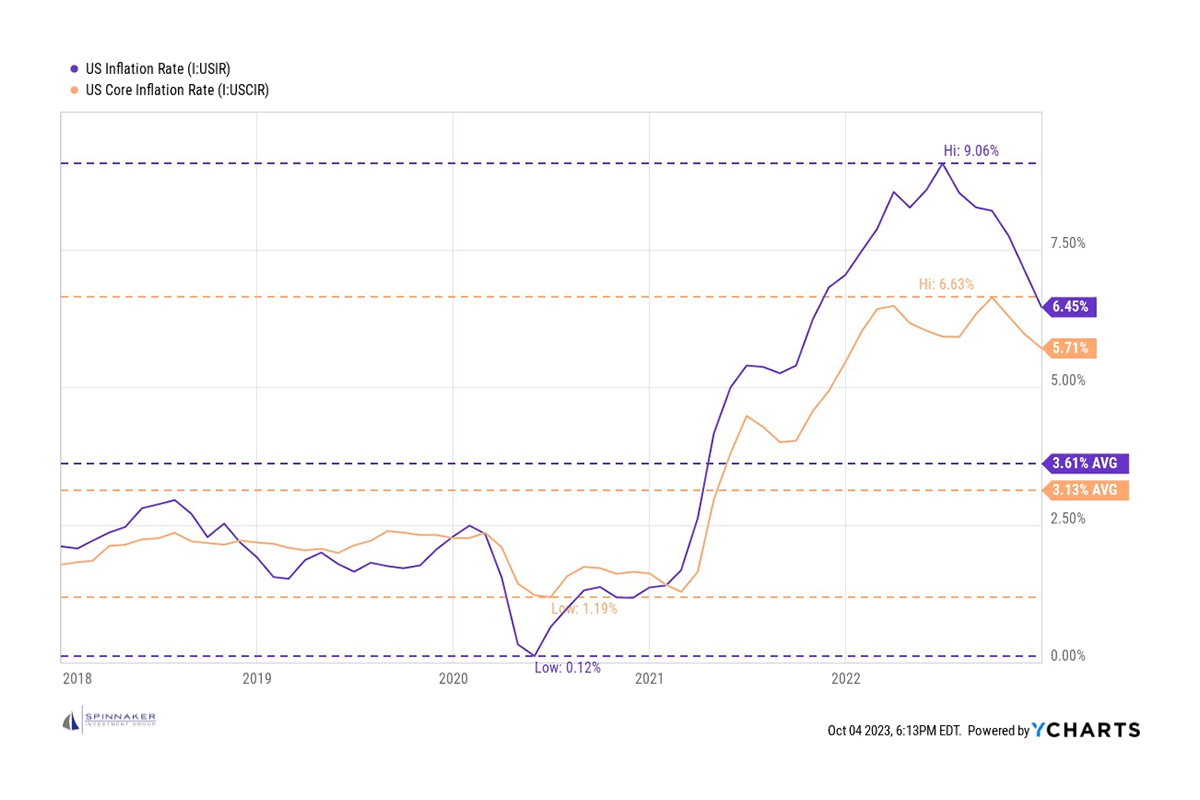

Reality has set in; rates will be higher for longer. Inflation has come down, but not to a point where the Fed is comfortable decreasing interest rates in the short term. Some inflation could still be on the horizon as auto worker (and other industries) strikes inevitably will lead to higher costs for the consumer. Oil has spiked as OPEC continues to throttle back production, leading North American oil producers to cut back production, which in turn pushes prices.

On the anti-inflation front, student loan payments resuming this month could take a bite out of consumers' wallets, leading to lower spending. We will all live through and learn what happens when a massive debt program is frozen for three years, then turned back on. Investors are unsure of the "soft landing" scenario they were pitched a few months back.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stocks

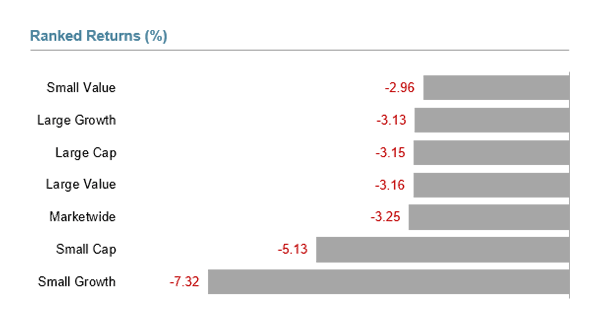

US equity markets posted negative returns for the quarter, be it large caps, small caps, value, or growth. The international and emerging markets had some sectors of gain. In the US, large growth stocks (even with the hit to the magnificent seven) performed better than their value compatriots.

Small growth stocks had a bad quarter, as they felt the effects of higher rates harder than others. On the international and emerging market fronts, we saw value stocks outperform their growth brethren.

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Income

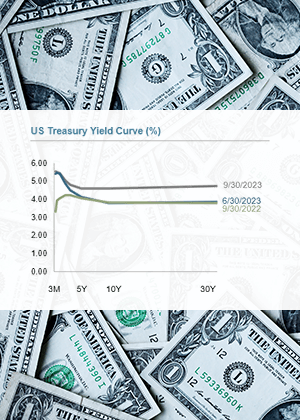

Interest rates increased across the entire curve. On the short end, the 1-year Treasury Bill increased 6 basis points to 5.46%, while the 2-year Bill increased 16 basis points to 5.03%. The belly of the curve saw the 5-year Note increase 47 basis points to 4.60% and the 10-year moved 78 basis points to 4.59%.

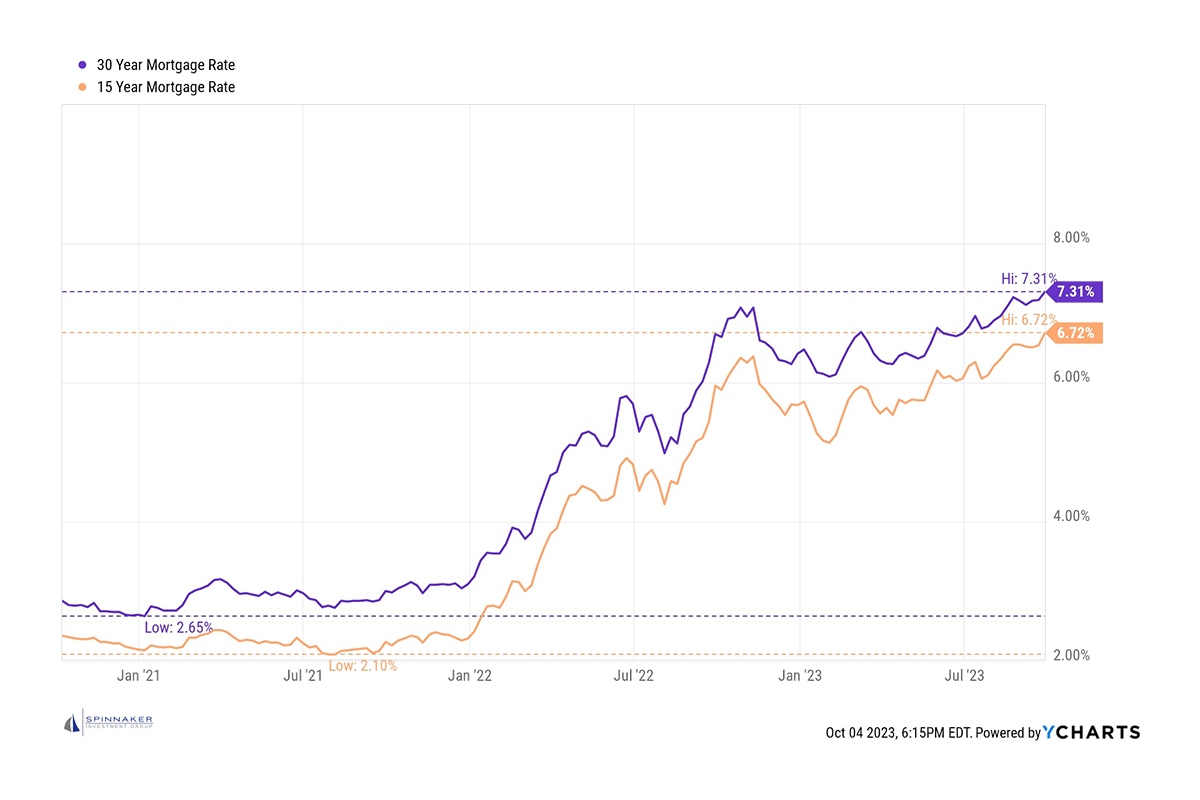

On the long end, the 30-year Bond increased 88 basis points to 4.73%. As of this writing, the 10- year is over 4.7%, a level not seen in sixteen years. The higher 10-year is wreaking havoc in the mortgage market as 30-year mortgages are north of 7%.

|

|

|

|

|

|

|

|

|

|

|

|

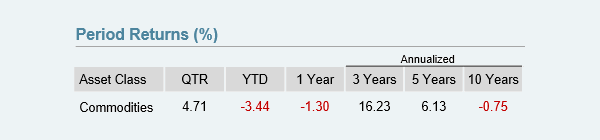

Commodities

Commodities showed some signs of life, and they were mostly pushed higher by oil. Low sulphur gas oil led the quarter with a 43.22% return and wheat sat at the bottom with a -20.02% return. Still not a great 10-year record for the sector but chipping away.

|

|

|

|

Looking Forward

I haven't Googled "top Halloween costume" yet but I assume "next speaker of the House" will be an option. As chaos ensues in Congress, the US will look like schmucks on the global stage as we just watched the first speaker, ever, to be removed by the US House.

I guess we shouldn't be surprised as we all heard our phones go off on October 4th at 11:18, not the 11:20 promised. The lack of a speaker matters as the deal just completed is only for 45 days, just in time for Thanksgiving. The chances of a deal being completed in 45 days look bleak.

|

|

|

|

|

As mentioned earlier, rates should remain higher for longer, but they seem to be leveling off. Rates look extremely attractive for savers and investors. We have been looking to lock in some longer-term bonds as 2024 could see rates move down at some point, especially if the economy cools.

October has the appearance of a frightening month, but historically not a bad time to add to stock exposure. Sure, there are a lot of spooky things out there, but if rates pull back in 2024, investors will be happy they remained in stocks. Lower yields could push stocks higher.

We look forward to speaking with you and we thank you for your continued support.

We thank you for your continued support and look forward to speaking with you.

|

|

|

|

|

Have You Taken

The SpinnCycle™?

A quick reality check for your portfolio

Enter the SpinnCycle and find your SpinnScore™

|

|

|

|

|

|

Spinnaker Mobile App now Available for IOS and Android

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2023 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Marketwide (Russell 3000 Index), Large Cap (Russell 1000 Index), Large Value (Russell 1000 Value Index), Large Growth (Russell 1000 Growth Index), Small Cap (Russell 2000 Index), Small Value (Russell 2000 Value Index), and Small Growth (Russell 2000 Growth Index). Dow Jones US Select REIT Index used as proxy for the US REIT market. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2022, all rights reserved. Stock return Charts from Dimensional Fund Advisors. Inflation is typically defined as the change in the non-seasonally adjusted, all-items Consumer Price Index (CPI) for all urban consumers. CPI data are available from the US Bureau of Labor Statistics. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. ast performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice.

|

|