|

|

|

|

|

|

Beware the

Dome Light

By Morgan Christen

CFA, CFP, CDFA, CEO and CIO

Welcome,

Perhaps you have seen the meme about the seven-year-old and his father's reaction to turning on the interior dome light of the car. I think we can all relate.

One of my first memories was sitting in the back seat of my father's '78 Monte Carlo, and when I turned on the dome light his reaction was as if I just hit the launch button on the US nuclear arsenal.

|

|

|

|

|

Switching on that little light initiated such an over-the-top reaction. "What are you doing?!" ...Ah, nothing. "Then why did you turn on the light?!" Sorry...

Why the reaction? I don't know. Perspective. I obviously had a reason to turn on the light; I spilled my box of Lemonheads, the same box I was told to not open until we got home.

|

|

|

|

|

If you never had the pleasure of driving in an American car of that era, let me paint a picture of the interior. Think old timey Vegas, tufted pleather with deep pleats and folds.

In other words, tons of areas for Lemonheads to hide in the dark, and I was only able to fill half the box by just feeling around. I knew what the reaction would be if I turned on the light but I had to find the rest of those little yellow candies. Another perspective.

|

|

|

|

|

|

We are often asked about our perspectives on the economy and where the market may be heading. The post-pandemic world is anything but normal and as they say, we are living in interesting times.

We see data that shows things are good, followed by another data point flashing red. We are all looking at the same set of numbers and coming to different conclusions. Could be the pandemic and the recovery events simply transcend the rules of traditional economics.

|

|

|

|

|

|

To wit, some inflationary data points are like my father's reaction to the dome light... nuclear winter.

Bond futures are no longer pricing a reduction in rates as we watched the January producer price index come in a bit spicier than traders thought.

|

|

|

|

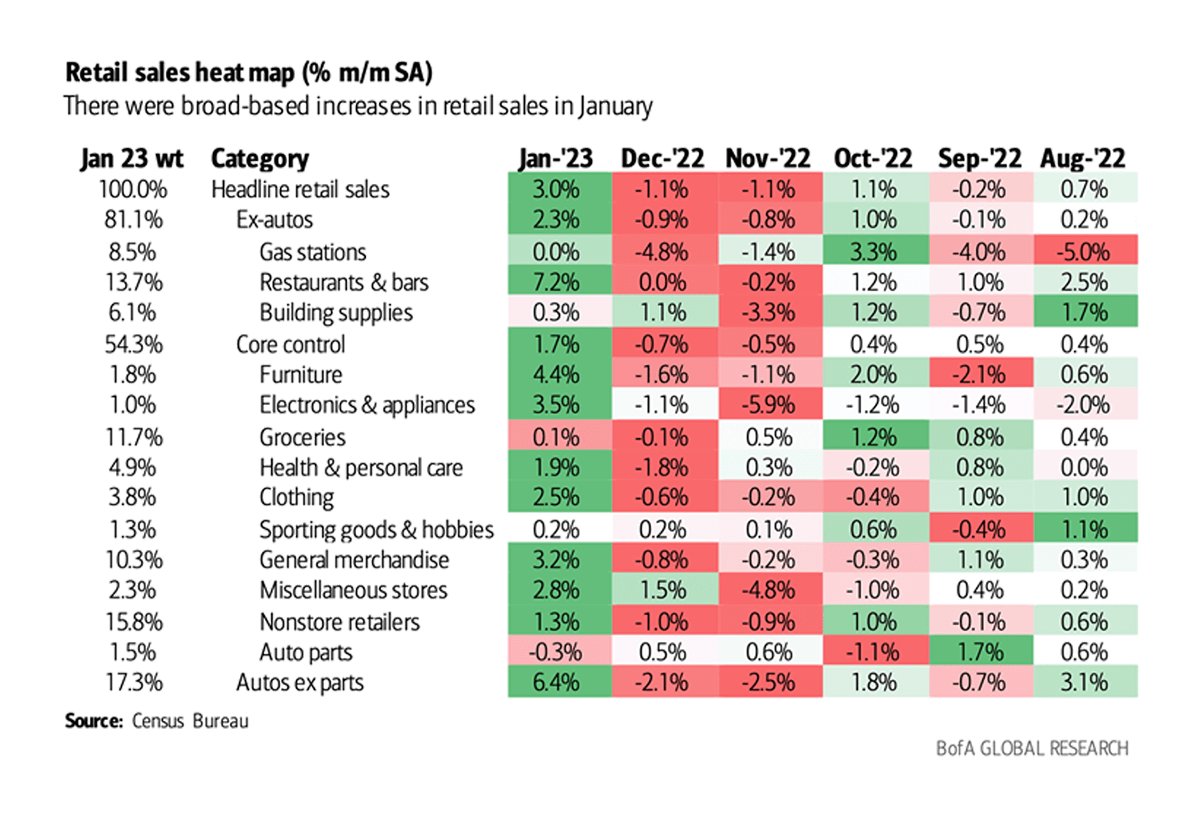

Retail sales also came in stronger than was anticipated as consumers pulled out their credit cards and spent.

Consumers also piled on debt as they increased total debt by $394 billion for a total household debt of $16.9 trillion (larger than the balance pre-pandemic).

|

With the uptick in items deemed inflationary, the FEDs job is not yet done.

That future rate (or inflation) increases could lead to a slower economy which is the markets current concern.

|

|

|

|

|

|

|

|

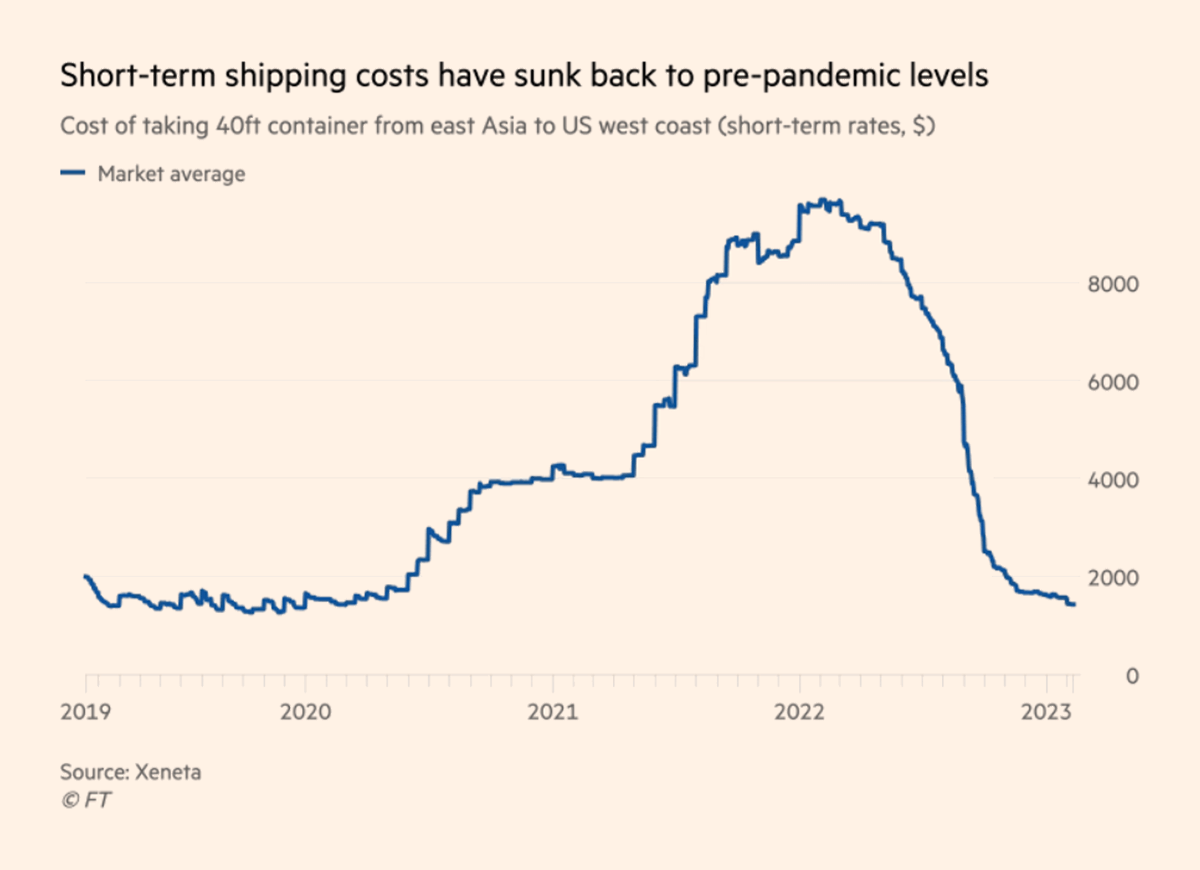

But that dome light is illuminating areas that could be judged as positive. Costs to ship goods across the ocean have come down dramatically.

One of the worlds biggest shipping companies, A.P. Moller-Maersk recently released earnings, which fell 18% year-over-year. And they project slow growth ahead.

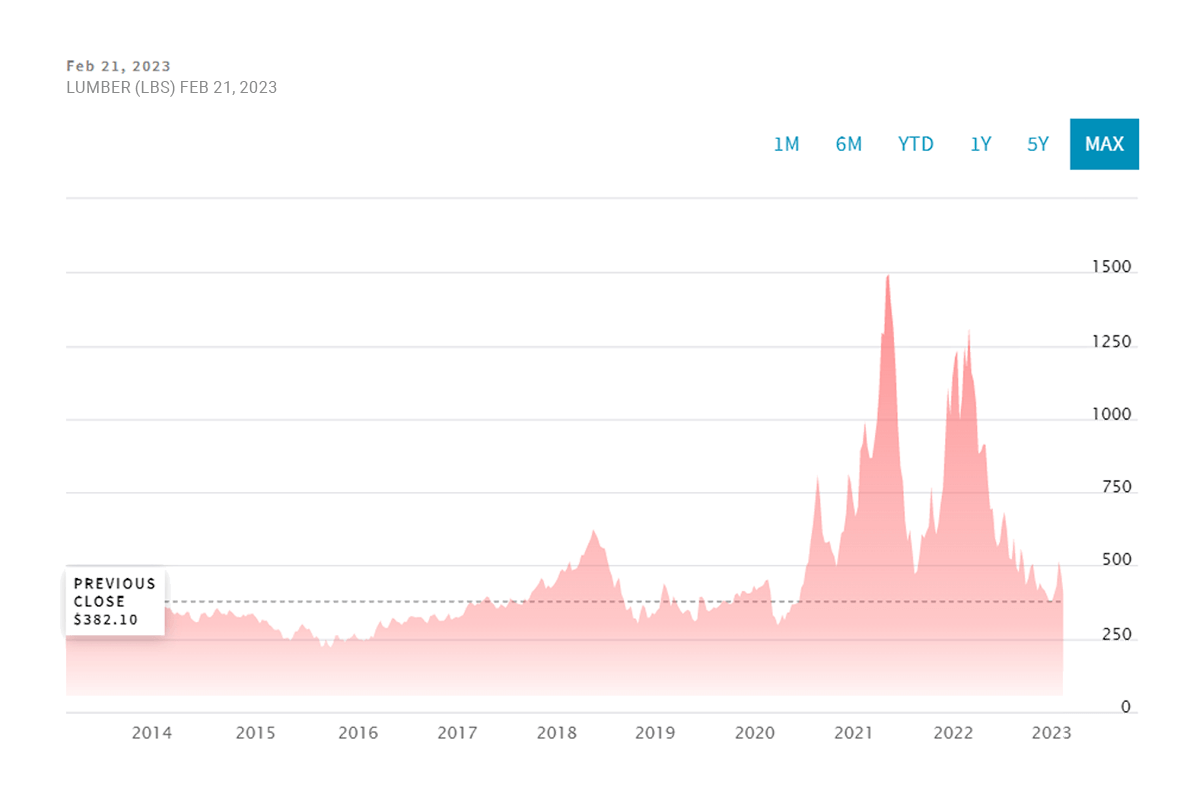

But those lower earnings came off their best results in history. Lumber prices, after major spikes, have come back in line with historic norms.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

It is a mixed bag out there. Watch some financial channels and you get the "winter is coming" dome light reaction, while others say, meh, we are fine.

Janet Yellen spoke last month and was quoted as saying it is "tough to have a recession with jobs." Former Federal Reserve Chair Alan Greenspan reputedly tracked men's underwear sales as an economic indicator. His thought was people would wait longer to replace these items if the economy was weak.

Maybe we should be concerned when you look at the stock chart on Hanesbrands (HBI) as it continues to move lower.

|

|

|

|

|

There is also the "lipstick effect," a theory proposed by economist and sociologist Juliet Schor. She found that more women bought lipstick during economic downturns while cutting back on more expensive products... affordable luxury. So, watch the crowds at the Mac counter.

Another area to track is "recession brunettes." Have you notices some of your friends that were blondes, are morphing into brunettes. That is sign that money is tight and the economy is slowing.

|

|

|

|

|

|

|

|

|

What does it all mean?

We are working through a transition we have never been through in modern times. Some folks are feeling the pain, while gamblers placed $16 billion in Super Bowl bets. We just went through Valentine's Day that saw consumers spending roughly $26 billion (highest on record) on the day. The inflation battle is not over, but at least we are settling in on bond yields.

Companies and consumers have found resolve in the new higher interest rate world. That is not a bad thing, free money regimes of the past have created the excesses that have bruised our economy. We at Spinnaker are settling in on these new rates. It is nice to get 4-5% on a bond. It is great to see rational views on stocks, it is all about earnings. As it should be.

The noise is loud on both sides, but we are here to keep you on track. If you feel you need to turn on the dome light, please let us know. We are here to calmly assist.

|

|

|

|

|

|

Have You Taken

The SpinnCycle™?

A quick reality check for your portfolio

Enter the SpinnCycle and find your SpinnScore™

|

|

|

|

|

|

Spinnaker Mobile App now Available for IOS and Android

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2023 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice.

|

|