| CONNECT |

|

|

|

|

|

|

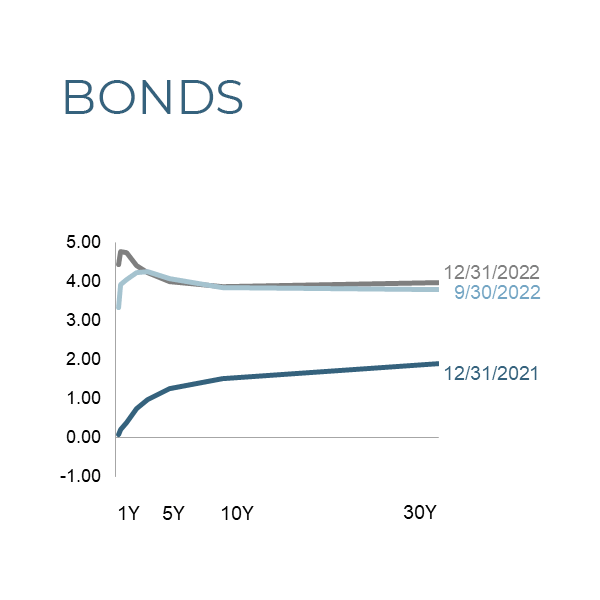

Then came June when Jay Powell and company went big and started their first 75 basis point rate hike, ending the year in the 4.25% - 4.50% range.

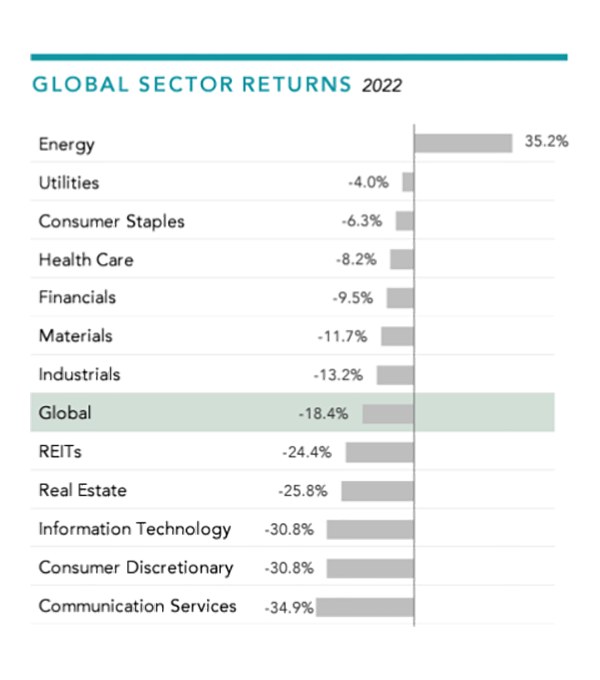

These rate increases caused havoc in the overvalued technology space. To name a few pinged by rates... |

Tesla off nearly 73%

Meta off 64% Netflix 51% Amazon nearly 50% Alphabet 39% Apple off 26% for the year If you are counting, the loss for Tesla is around $720 billion of shareholder value in 2022. |

|

|

|

|

|

|

|

|

|

|

|

|

|

What Can Be Expected In 2023?

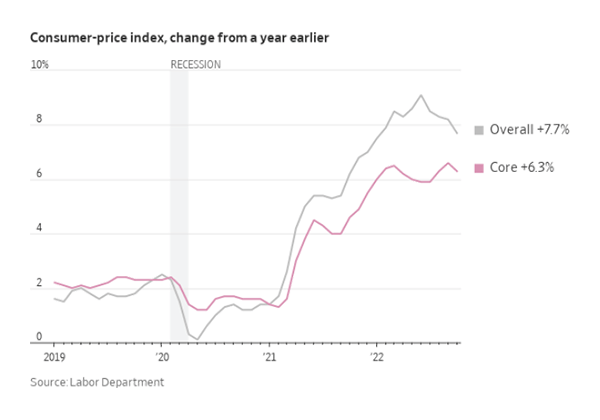

We expect the effects of interest rate increases to slow the economy. Inflation should moderate, which will allow Fed rate increases to end. Our greatest concern is that the economy declines, and the Fed decides to cut rates. A rate cut could trigger animal excesses (again) which could spike inflation to higher levels than we saw in 2022. |

We could see continued layoffs in the labor market. Currently tech is seeing the lion share, but tightening could expand beyond that sector.

Real estate will sit in no man's land as prices in core areas could remain high, sellers have not embraced reality and really don't need to sell. Rates will hurt buyers, but there really won't be any supply to absorb. |

|

Any of the VRBO hot spots could suffer. Vacation areas as well as overly purchased communities will feel the pain.

Additionally, those who bought houses during COVID may see their equity go negative, so time will tell if those buyers have staying power. Will there be a recession? Maybe. |

With the hit to stocks last year, markets have already discounted a recessionary event.

If history serves, the market will start its move up by the time we are "officially" in a recession. The Fed should have a couple more hikes in their future, but the forward curve suggests easing at the end of this year. |

|

Have You Taken

The SpinnCycle™? A quick reality check for your portfolio Enter the SpinnCycle and find your SpinnScore™ |

| Spinnaker Mobile App now Available for IOS and Android |

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence. © 2023 Spinnaker Investment Group. All Rights Reserved. Disclosures |

GET IN TOUCH

949.396.6700 info@spinninvest.com spinninvest.com 4100 MacArthur Blvd., Ste 120 Newport Beach, CA 92660 |

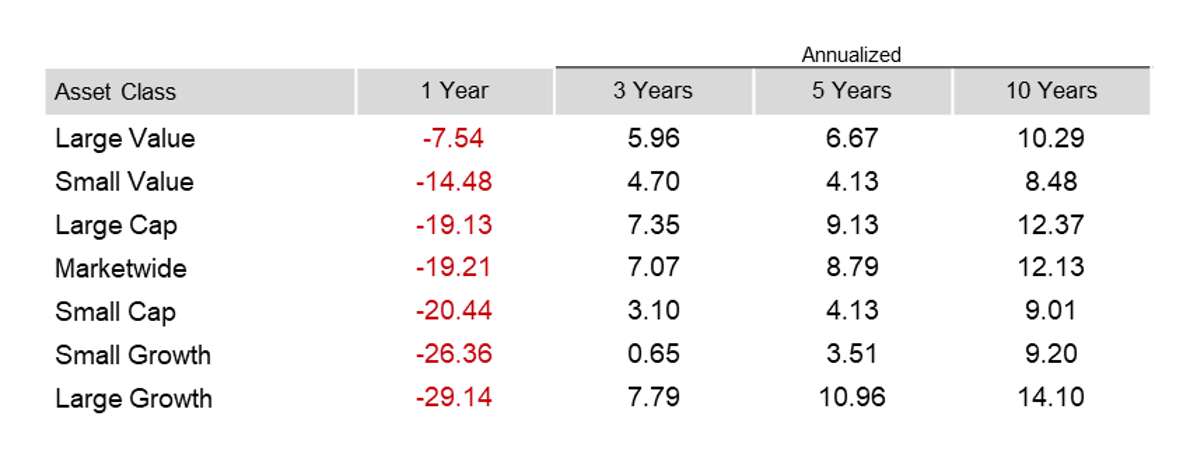

| DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Marketwide (Russell 3000 Index), Large Cap (Russell 1000 Index), Large Value (Russell 1000 Value Index), Large Growth (Russell 1000 Growth Index), Small Cap (Russell 2000 Index), Small Value (Russell 2000 Value Index), and Small Growth (Russell 2000 Growth Index). World Market Cap represented by Russell 3000 Index, MSCI World ex USA IMI Index, and MSCI Emerging Markets IMI Index. Russell 3000 Index is used as the proxy for the US market. Dow Jones US Select REIT Index used as proxy for the US REIT market. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2023, all rights reserved. Yield curve data from Federal Reserve. State and local bonds, and the Yield to Worst are from the S&P National AMT-Free Municipal Bond Index. AAA-AA Corporates represent the ICE BofA US Corporates, AA-AAA rated. A-BBB Corporates represent the ICE BofA Corporates, BBB-A rated. Bloomberg data provided by Bloomberg. US long-term bonds, bills, inflation, and fixed income factor data © Stocks, Bonds, Bills, and Inflation (SBBI) Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). FTSE fixed income indices © 2023 FTSE Fixed Income LLC, all rights reserved. ICE BofA index data © 2023 ICE Data Indices, LLC. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. |