|

|

|

|

|

|

Notify the Bees

By Morgan Christen

CFA, CFP, CDFA, CEO and CIO

Welcome,

Not well known to most Americans is the act of notifying the bees when someone dies.

When Queen Elizabeth II died, the royal beekeeper informed the bees that she had passed.

|

|

|

|

|

Why would he need to let the bees know? Mostly because of tradition and a standard practice that goes back centuries. It is said bad consequences come if the bees are not notified, which may also be a superstition at this point.

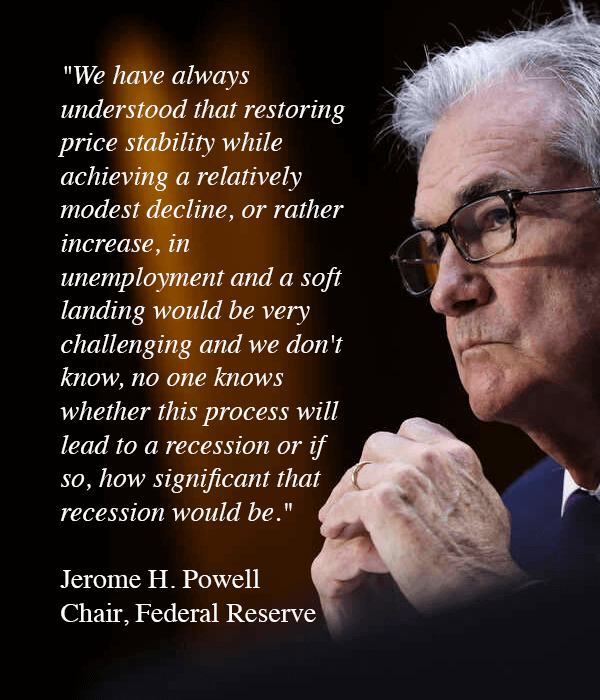

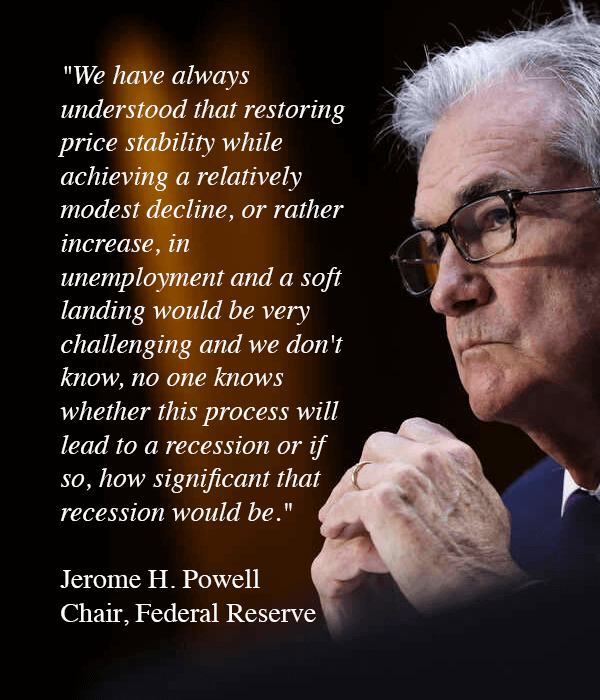

The Fed has let investor bees know they are going to continue raising rates, even at the expense of jobs and potentially forcing a recession.

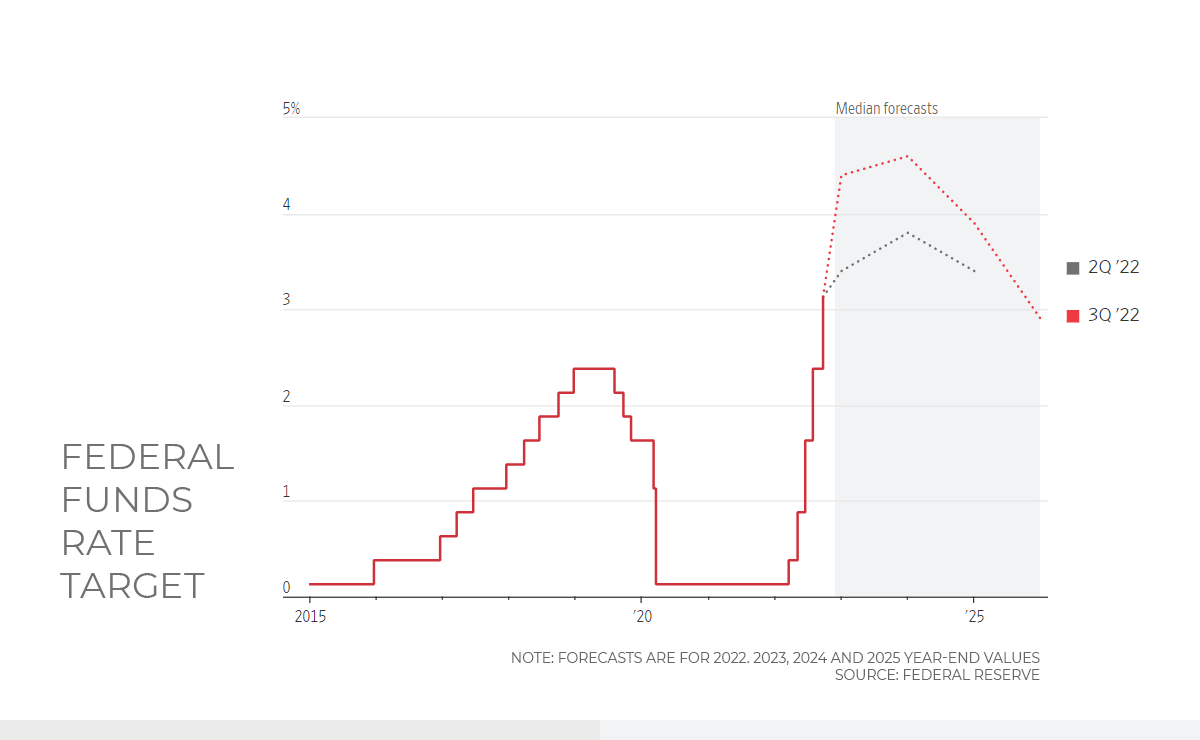

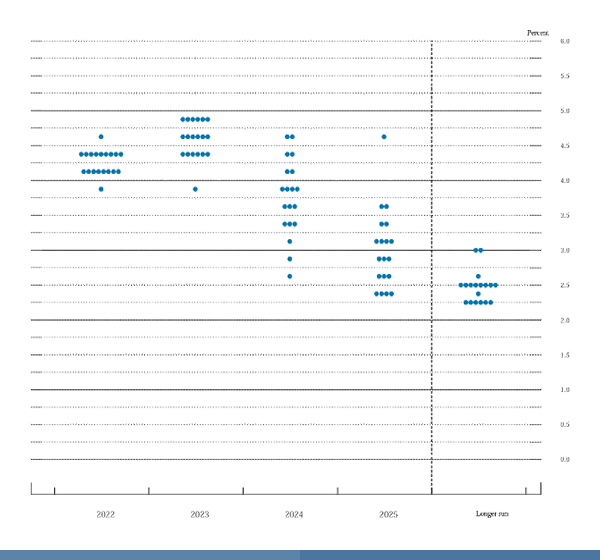

Fed officials projected rates increases will continue into 2023, with an expected terminal rate of 4.6% by the end of 2023.

|

|

|

|

|

|

|

|

|

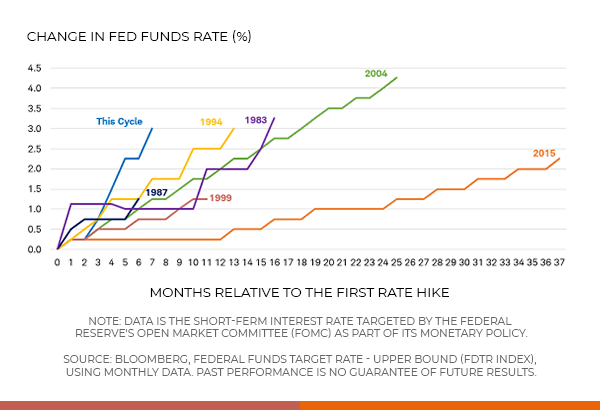

The Fed rate increase has been moving faster than at any time in modern history, and markets were not prepared. Especially the bond market.

All major markets are feeling jittery as they wait and anticipate the next move. All markets have been impacted and will continue to be.

|

In past rate-hike regimes, the Fed would pause to assess the impact.

The Fed and rates will be the topic du jour for all markets going forward.

If they pause, markets will cheer, but don't make any decisions based on that hope.

|

|

|

|

|

|

|

|

|

The actions by the Fed are also having an impact worldwide, as we see currency markets swooning. The Bank of England (BOE) had to launch emergency operations to prevent a collapse in the UK bond market. The BOE was on a path to tamp down inflation, much like the Fed.

|

The BOE had a plan to end quantitative easing and sell off long term bonds, but quickly reversed and began "temporary purchases" to restore an orderly market. Oh, they also wanted to prevent a financial meltdown and another "Lehman moment." So there is that.

|

|

|

|

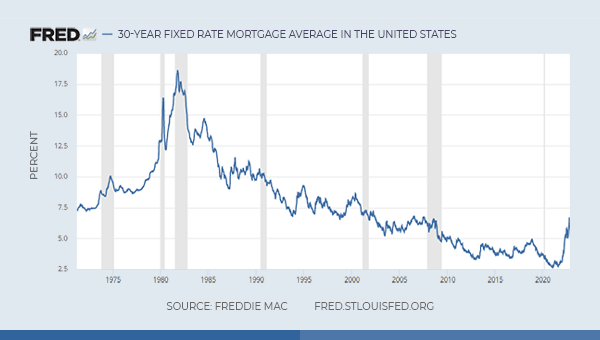

A look back is warranted at this point, and the housing market would be a good place to start. Mortgage rates have more than doubled this year.

Assuming you had a $750,000 30-year mortgage, your payment in 2021 assuming a 2.6% interest rate was $3,002.

That same payment only affords you a mortgage in the amount of $465,310 at the current 6.7% rate.

|

|

|

|

|

|

|

|

|

|

But as we have talked about in the past, homeowners are sitting on a lot of equity, which could start to drop as prices move downward.

Homeowners may not be in love with their house, but they are deeply in love with their interest rate.

The adoration of their interest rate may hold down inventory as sellers stand pat.

|

Of more concern is the loss of perceived wealth. When the stock market moves up, investors tend to spend roughly 2% of the gains. Investors feel the stock market growth may be more transitory.

However, when housing moves up, people tend to spend roughly 10% because they assume housing gains to be permanent. That is a large chunk of spending that could dissolve as housing takes a breather.

|

|

|

|

|

|

|

|

|

Stocks

|

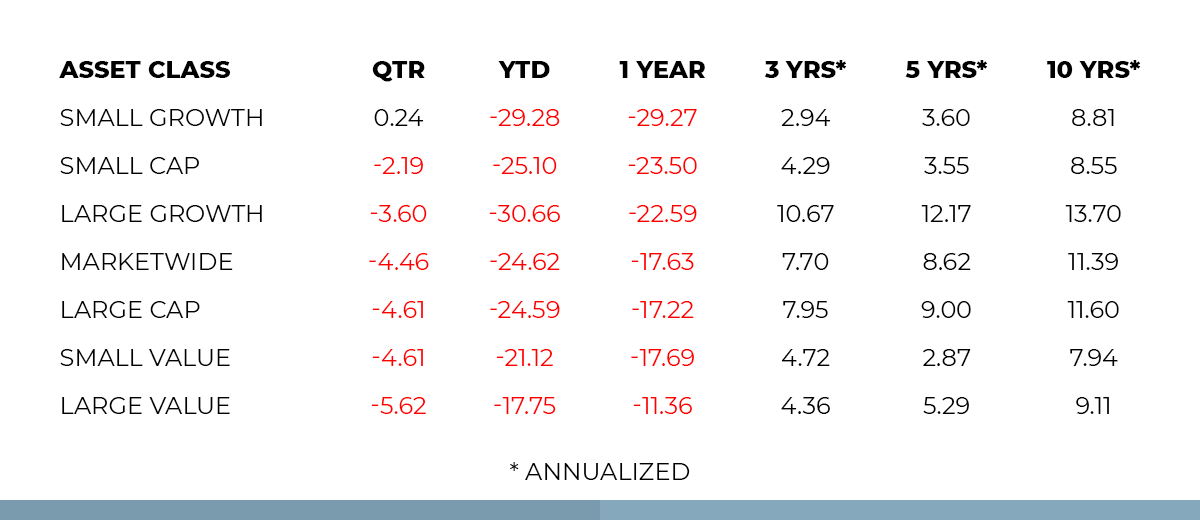

The third quarter started with a bang but ended with a whimper. US equity markets were mostly negative, save small cap growth stocks. However, US stocks bested their international and emerging market peers.

In a reversal of last quarter, growth stocks outperformed value stocks. As a reminder, those in the market over five years have been well rewarded from Mr. Market.

|

|

|

|

|

|

|

|

|

Bonds

|

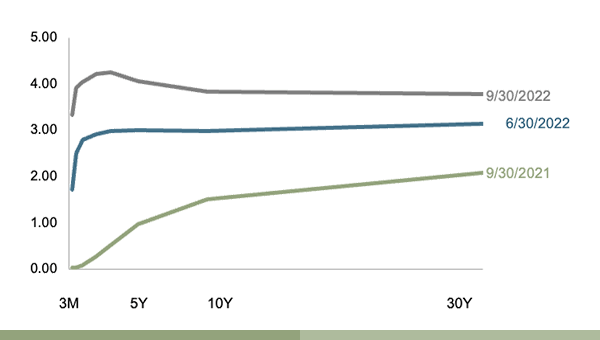

Interest rates moved up across the curve but were more pronounced on the short end. The short end being the "engineered" part of the curve as the Fed has gone on their rate hike campaign.

The move in the 5-year Treasury Note increased 105 basis points (bps) to 4.06% while the 10-year moved 85 bps to 3.83%. Further out on the curve we watched the 30-Year Treasury Bond move 65 bps to 3.79%.

|

|

The short end of the curve saw the 1-month US Treasury Bill increase 151 bps to 2.79%, the 1-Year increased 125 bps to 4.05% and the 2-Year increased 130 bps to 4.22%. Finally, a decent rate for savers.

While the Fed was stuck at the library researching clues for inflation, the members of Tau Kappa Inflation were drinking in the low rates.

|

Finally hearing the loud music and revelry, folks at the Fed went to the TKI frat house and now taking triple shots to catch up. A little late - we are all buzzed.

Needs to be done, but as stated earlier we have not seen this intensity in modern history. Probably time to pause a bit to see what has happened in the economy. Don't drink too fast!

|

|

|

|

|

|

|

|

Now What

Investor sentiment is near record levels according to the AAII Sentiment Survey. Bearish sentiment logged in at 60.8%, the first time in history the indicator was above 60 for consecutive weeks. As they say, it is always darkest before dawn.

To note, bear/bad markets end and have set the foundation for higher highs. Pessimism also ends. So, the Fed "soft landing" may be out the window and you can expect additional Fed hikes. But as the dot plot shows, they currently have a terminal number. They see an end.

|

|

|

|

|

But I implore you to look long term. Based on the AAII sentiment, investors think this will never end - in fact the reading is worse than the crash of 1987, the tech bubble, the financial crisis and the Covid 100-year pandemic.

It would appear we are going to hit peak pessimism in equities soon. Will it stop? Yes, it will. Remember the final capitulation in March of 2009? The markets went on one heck of a ride from that point.

We look forward to speaking with you soon. As always, we appreciate your support and trust in Spinnaker.

|

|

|

|

|

Have You Taken

The SpinnCycle™?

A quick reality check for your portfolio

Enter the SpinnCycle and find your SpinnScore™

|

|

|

|

|

|

Spinnaker Mobile App now Available for IOS and Android

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2022 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Marketwide (Russell 3000 Index), Large Cap (Russell 1000 Index), Large Value (Russell 1000 Value Index), Large Growth (Russell 1000 Growth Index), Small Cap (Russell 2000 Index), Small Value (Russell 2000 Value Index), and Small Growth (Russell 2000 Growth Index). Dow Jones US Select REIT Index used as proxy for the US REIT market. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2022, all rights reserved. Stock return Charts from Dimensional Fund Advisors. Inflation is typically defined as the change in the non-seasonally adjusted, all-items Consumer Price Index (CPI) for all urban consumers. CPI data are available from the US Bureau of Labor Statistics. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. The indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. Index returns and yield curve courtesy of Dimensional funds. Dot plot courtesy of the FED.

|

|