| CONNECT |

|

|

|

|

|

|

|

Interest Rates

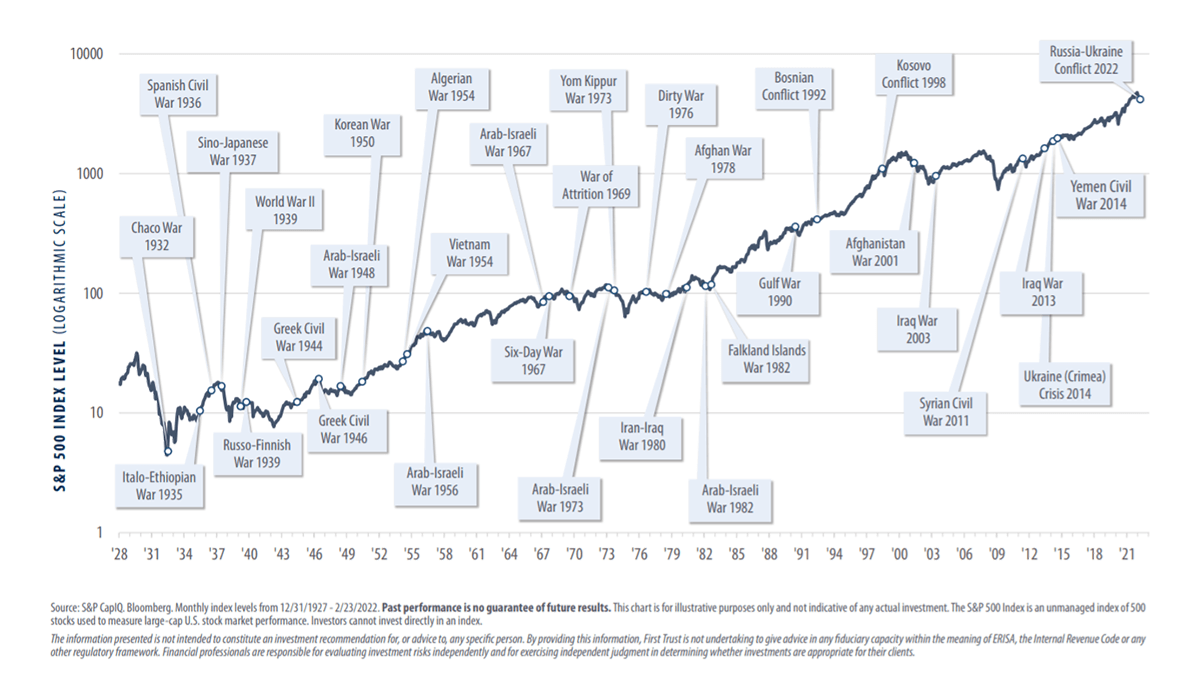

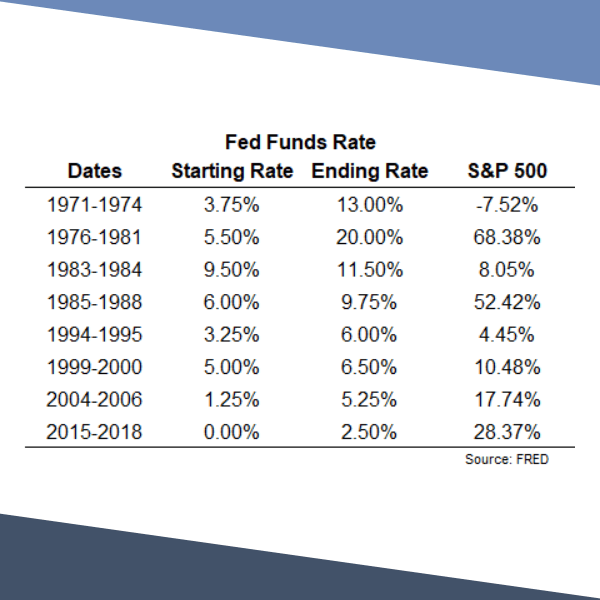

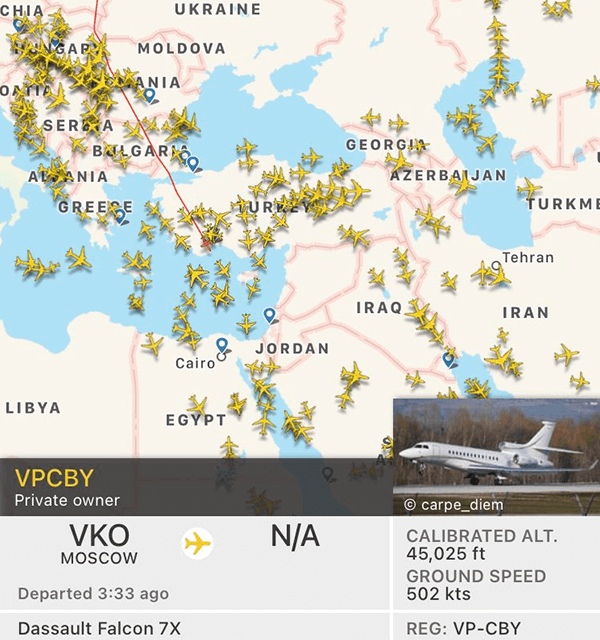

For markets and investors, there is something that is of far more concern than Russia and that is inflation and the Fed's reaction. We will not join the fray in guessing when and how many interest policy changes will occur, other than to say that they will happen. Frankly, it is time. Savers should be able to get some earnings on a bank account and yes there is inflation. |

In a zero-interest rate world, asset values can essentially be infinite as the discounted cash flows are brought to the present; no discount rate equals large values.

It is no surprise that companies with less current earnings and more speculative outcomes were hit the hardest by the new world of (slightly) higher interest rates. Higher rates (even aggressive increases) generally do not spell the end of market runs. |

|

|

|

|

|

Have You Taken

The SpinnCycle™? A quick reality check for your portfolio Enter the SpinnCycle and find your SpinnScore™ |

| Spinnaker Mobile App now Available for IOS and Android |

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence. © 2022 Spinnaker Investment Group. All Rights Reserved. Disclosures |

GET IN TOUCH

949.396.6700 info@spinninvest.com spinninvest.com 4100 MacArthur Blvd., Ste 120 Newport Beach, CA 92660 |

| DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. |