| CONNECT |

|

|

|

|

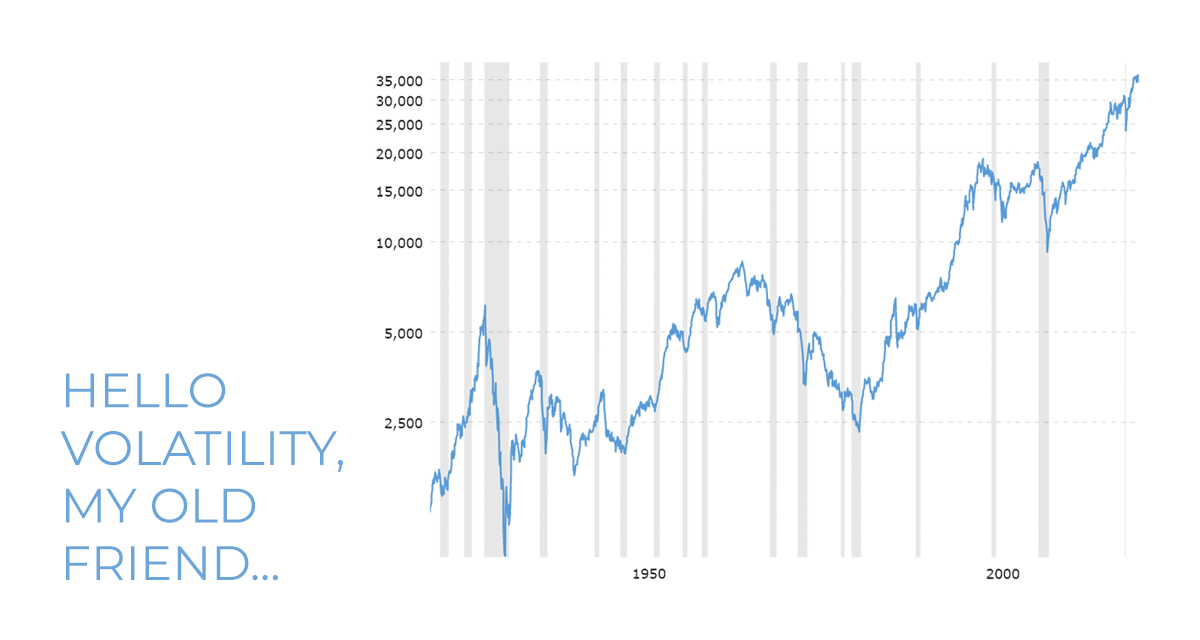

Betty also saw many years of the stock market; below is the Dow Jones Industrial Average (DJIA) from her birth to death. She was a young girl when the depression hit, but a grown woman during the 1970's.

During both of those time periods she could have easily accentuated the negative in the market. |

Without adjusting for dividends and inflation, the DJIA grew at an average rate of roughly 7.75% during her life.

Assuming Betty's parents invested $100 when she was born and she averaged a 7.75% rate of return, she would have $174,472 one-hundred years later... the beauty and power of compound interest. Oh, and that is with some brutal down-drafts. |

|

|

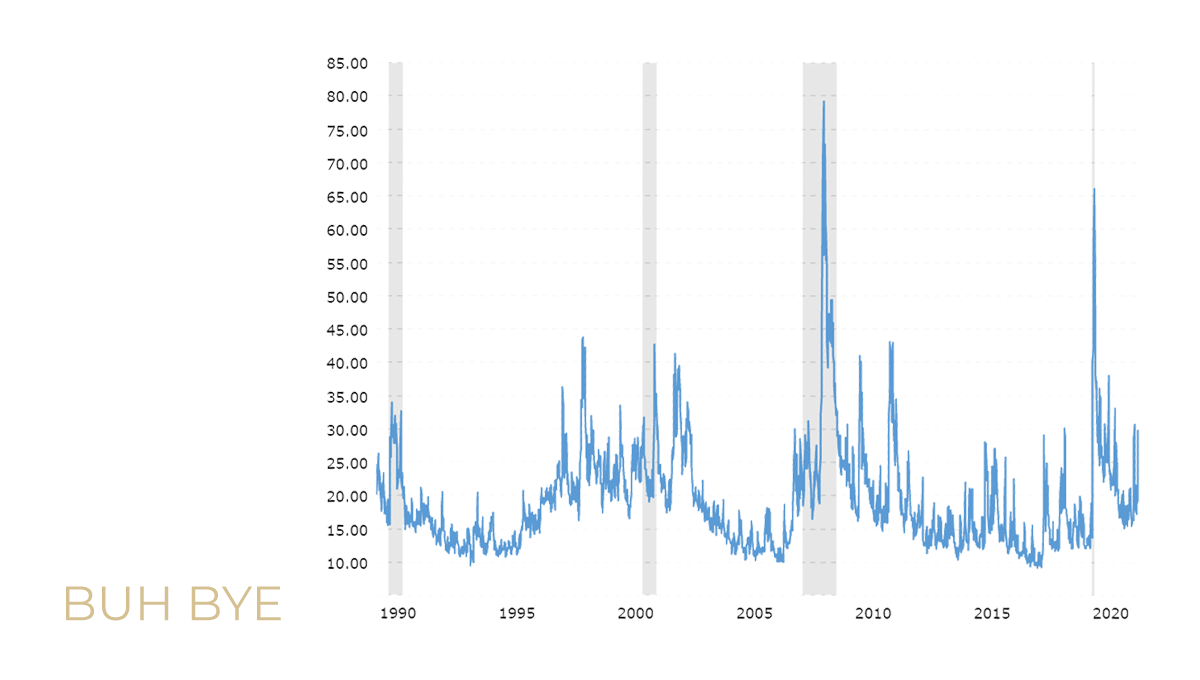

Volatility, as tracked by the VIX, does not go back nearly as long as the DJIA, but the chart shows it has been around for a while.

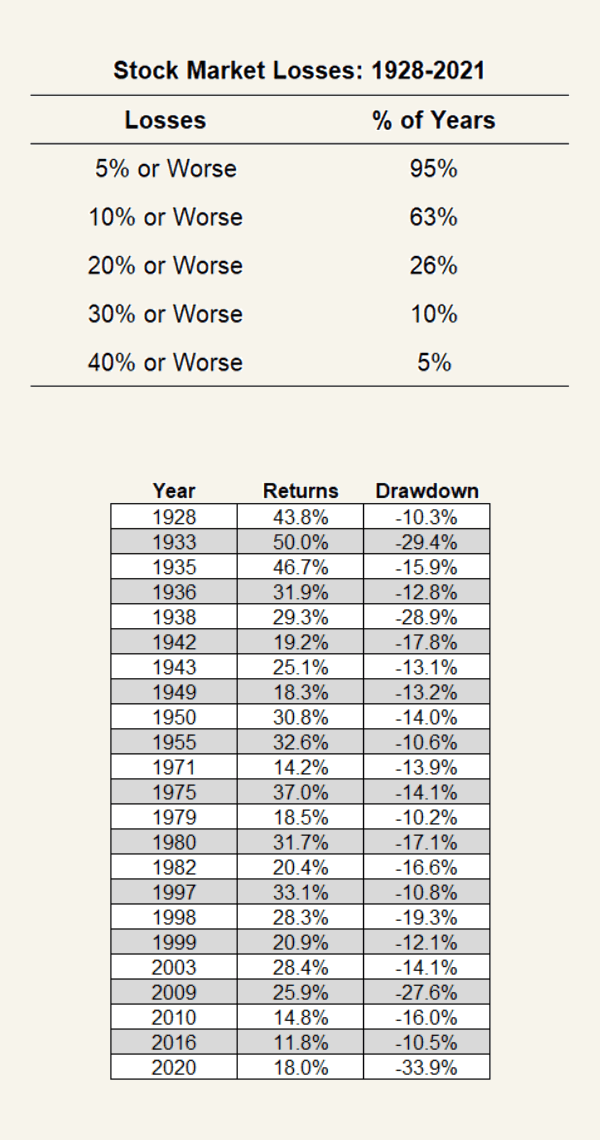

Down markets happen from time-to-time, and you can't expect positive returns in the long run without the occasional loss. In fact, in January the S&P 500 and the Nasdaq dipped into the "correction zone," a 10% drop. As you will see in the chart that has happened 63% of the time since 1928. |

A bear market type of reversal tends to be rare. What we are experiencing is more in line with a correction, not the end of the world as we know it.

2020 was a year that looked like a large crash, dropping 34%, only to finish the year up double digits. The ultimate market irony: All past declines look like opportunities while all future declines look like risks (source unknown). |

|

|

|

|

|

Have You Taken

The SpinnCycle™? A quick reality check for your portfolio Enter the SpinnCycle and find your SpinnScore™ |

| Spinnaker Mobile App now Available for IOS and Android |

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence. © 2022 Spinnaker Investment Group. All Rights Reserved. Disclosures |

GET IN TOUCH

949.396.6700 info@spinninvest.com spinninvest.com 4100 MacArthur Blvd., Ste 120 Newport Beach, CA 92660 |

| DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. Stock loss and return/drawdown charts courtesy of Ritholtz Wealth. DJIA chart. Volatility chart. |