| CONNECT |

|

|

|

|

|

|

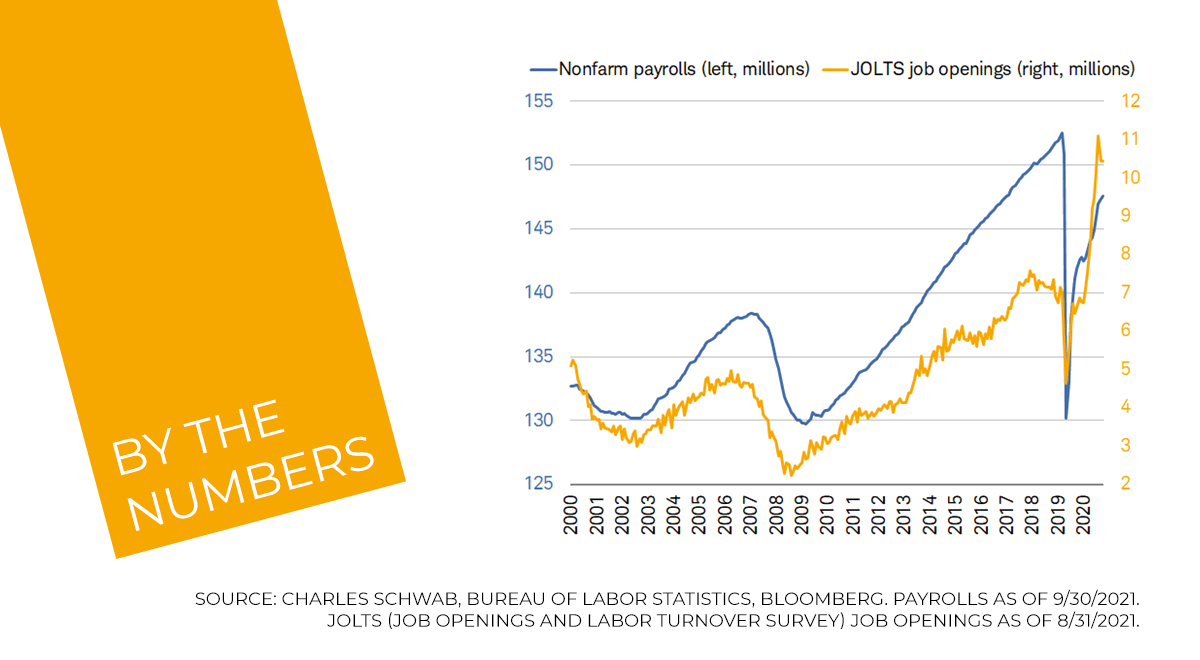

Let's look at the numbers since the weak month of September. October set the stage for a nice reversal in September's numbers. To be clear, many issues remain.

Supply chain bottle necks have not been resolved, as labor and materials remain scarce.

Supply chain bottle necks have not been resolved, as labor and materials remain scarce.

We still have more job openings than workers looking to fill the positions. All of these are putting pressure on costs. |

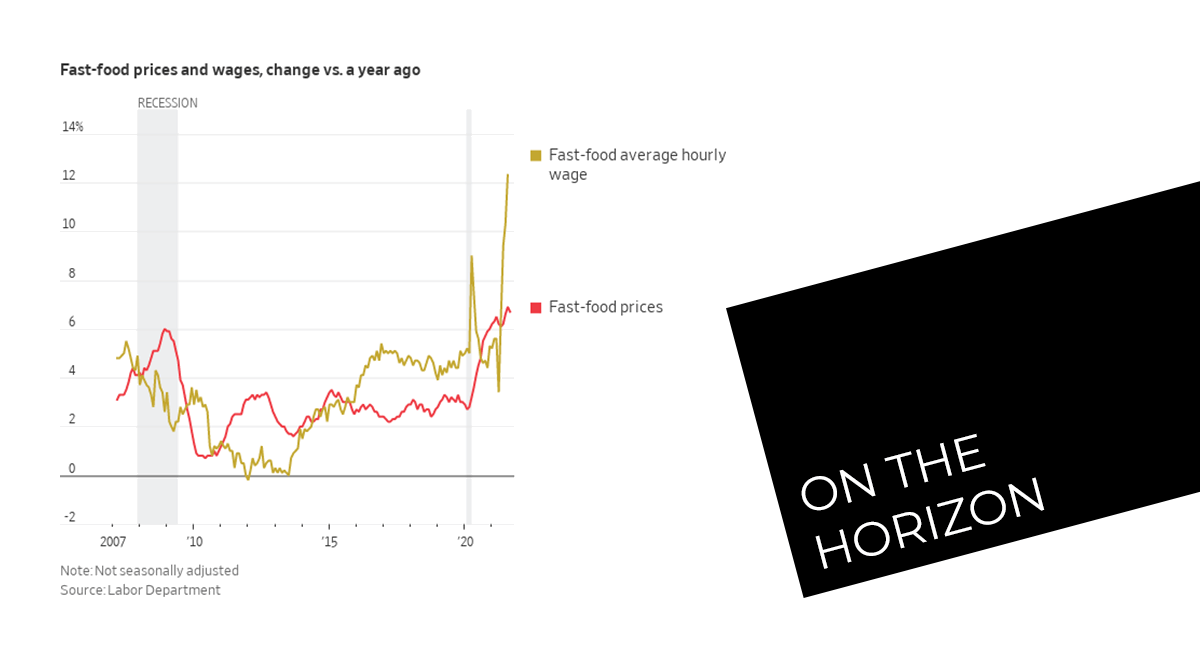

This leads to questions on inflation. Prices have moved up, but some areas are transitory. Lumber is back down, while oil has remained high. But this does not seem to be like the inflation of the 70's.

Wages will stay high, the supply chain will clear, and workers need to get to work. Should work force participation remain low, we could see lower inflation numbers if there is a corresponding reduction in demand. |

|

|

The S&P finished up almost 7%, while technology pushed higher as we saw the Nasdaq push up over 7%. Small companies moved forward over 4% and even international markets logged roughly 2% gains.

Will this continue? Possibly. The opening trade seems to be finally playing out, as Covid numbers remain low. The consumer has not slowed buying, even as prices have increased. |

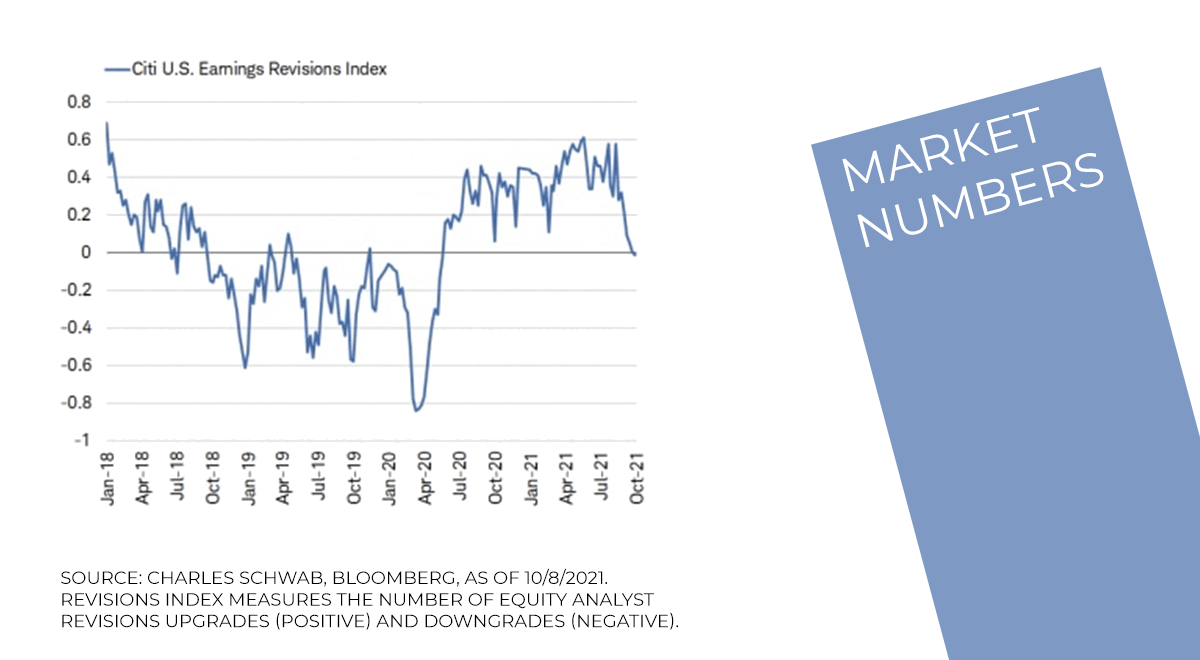

Companies have reported mixed results as the supply chain has been mentioned as one of the main culprits of weaker earnings. Analysts have lowered earnings expectations going forward.

The Fed will be meeting shortly and the "tapering" of bond purchases appears to be baked into current returns. The Fed should remain highly accommodative as they have moved away from worrying about inflation and are hyper-focused on employment. |

|

|

|

|

Have You Taken

The SpinnCycle™? A quick reality check for your portfolio Enter the SpinnCycle and find your SpinnScore™ |

| Spinnaker Mobile App now Available for IOS and Android |

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence. © 2021 Spinnaker Investment Group. All Rights Reserved. Disclosures |

GET IN TOUCH

949.396.6700 info@spinninvest.com spinninvest.com 4100 MacArthur Blvd., Ste 120 Newport Beach, CA 92660 |

| DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. |