| CONNECT |

|

|

|

|

|

| Given the supply chain issues, stimulus, and unemployment, there are outside forces stoking inflation. But the other assumption is, if the easy money policy is left in place, inflation could get out of hand. | At the present time, Powell is going with the fewest assumptions and keeping the current easy money policy in place. In the short run, companies and consumers are going to be dealing with volatility in prices as well as products. |

|

A few facts illustrating the current supply chain situation: Dollar Tree has said they would sell more items above $1.

Why could that be?

Why could that be?

Look off the coast of Long Beach and admire the 65 vessels waiting to enter (no those aren't cruise ships). And the chip shortage alone is estimated to cost $210 billion this year. |

All these issues were brought to us by the letter C, Covid. From the data we review, Covid is waning, and Merck just announced a Covid anti-viral pill that cuts the risk of death and hospitalization.

These data points should get people back to work, which should help the ports, which could help the supply chain bottleneck. If those do happen, you could see inflation subside and the economy take off. Path of least resistance for the win. |

|

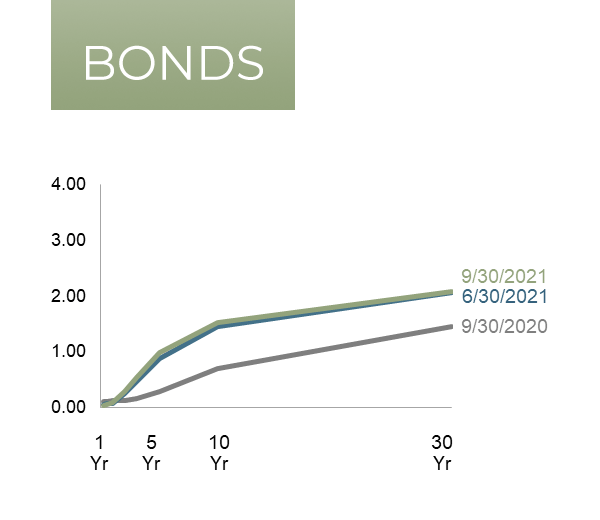

| Rising rates can have a deleterious effect on stocks, especially in higher growth tech stocks. When you look at the price-to-earnings on some tech stocks, they look expensive relative to their future earnings in a higher interest rate regime. | It was reported the market cap loss of the FAANG stocks (Facebook, Amazon, Apple, Netflix and Alphabet) was $486.4 billion in the month of September. But higher yields (rates) can also be looked at as an improving and/or more normal economy. |

|

|

|

Other Market Assumptions

Congress passed a last-minute reprieve on spending and pushed the shutdown out until December 3rd. We still have the active debate on the debt ceiling, due by October 18th. Just a note, this is not a decision to stop spending, as both sides will continue to spend. This is merely raising the ceiling on the amount of debt we issue. It is one of the dumbest arguments in Congress. |

We know we are going to blow through the ceiling, but let's hold the electorate hostage as we saber-rattle.

We know we are going to blow through the ceiling, but let's hold the electorate hostage as we saber-rattle.

Perhaps you have seen the #MintTheCoin on social media. This came about during the debt ceiling issues in 2011. The idea is for the Treasury to mint a $1 trillion platinum coin to cover our bills. By the way, this is legal. |

What Else Is Going On?

What Else Is Going On?

Well, China looks like they are reversing decades of progress towards capitalism and heading back to the vision of Mao Zedong. They have cracked down on crypto (maybe not a bad idea), blocked education companies from earning a profit, limited video games for kids and shut down the Chinese Uber, Didi. |

Chinese leadership is moving toward greater control of society and the economy under the "common prosperity" plan. Under this plan, individuals will be made whole, while corporations, stockholders and bond holders not so much.

The Evergrande episode a few weeks ago played out in sync with the common prosperity plan. This is an evolving issue. Leadership is essentially saying 'thank you world, for investing in us and growing us into a power; now we are taking our ball and going home.' |

|

|

Stocks

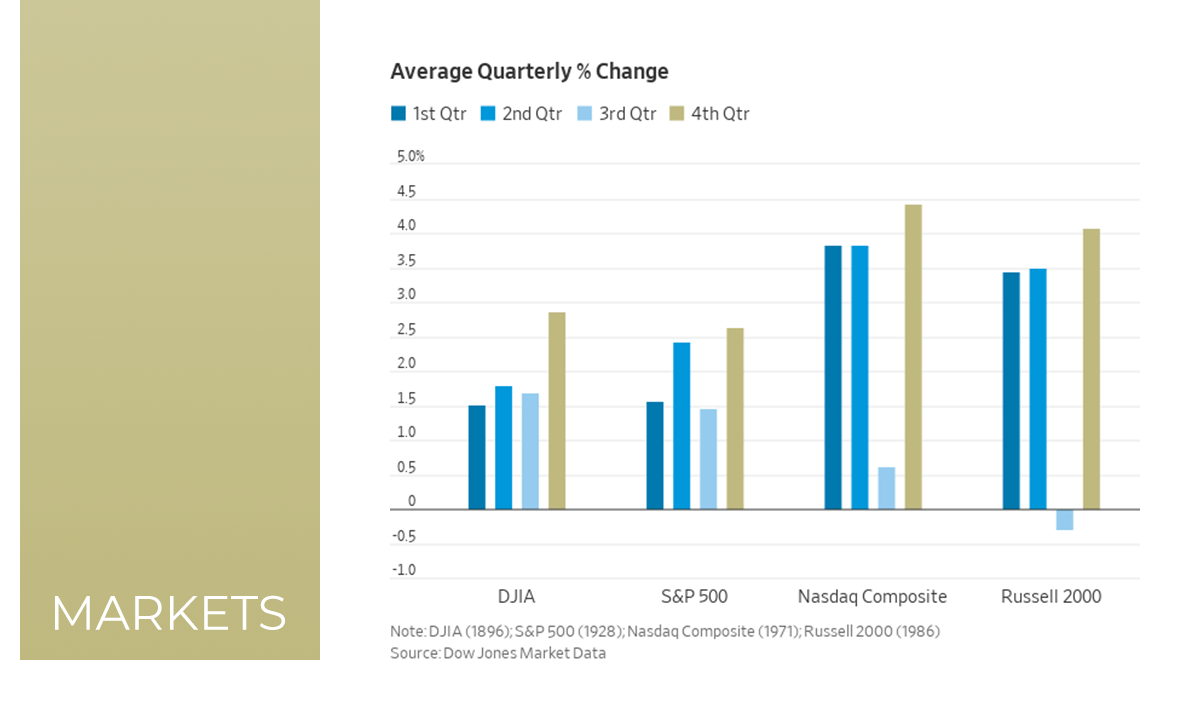

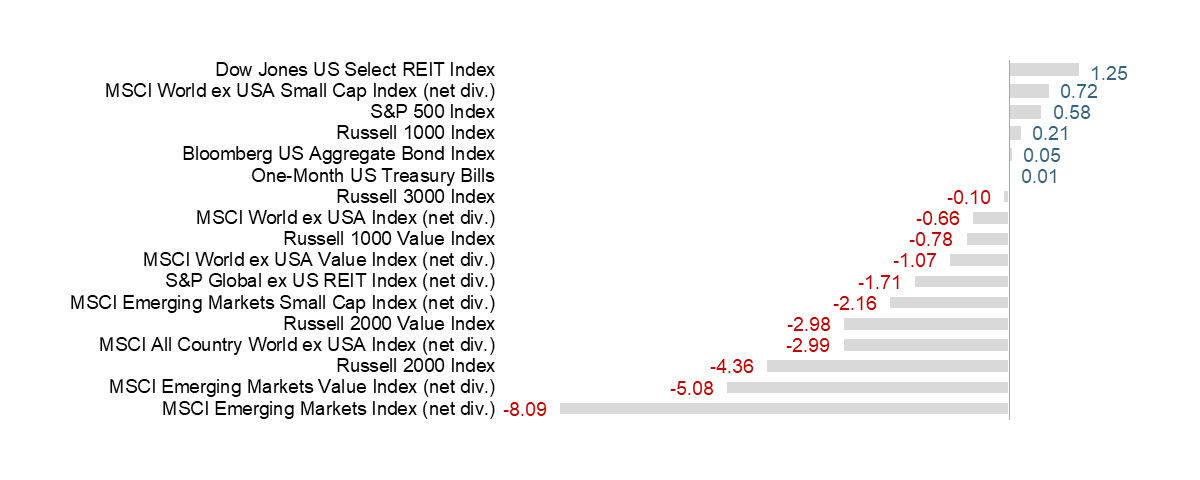

As stated earlier, equity markets had a lackluster third quarter. REIT investments took the top spot while emerging markets came in last. US markets were mostly flat with large growth stocks outperforming value and smaller stocks. |

In the international market, smaller stocks edged out larger stocks.

Energy stocks held up well, as natural gas was the top performing commodity. Gold and silver both posted negative returns. |

|

|

|

|

|

Have You Taken

The SpinnCycle™? A quick reality check for your portfolio Enter the SpinnCycle and find your SpinnScore™ |

| Spinnaker Mobile App now Available for IOS and Android |

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence. © 2021 Spinnaker Investment Group. All Rights Reserved. Disclosures |

GET IN TOUCH

949.396.6700 info@spinninvest.com spinninvest.com 4100 MacArthur Blvd., Ste 120 Newport Beach, CA 92660 |

| DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. The S&P data is provided by Standard & Poor's Index Services Group. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2021, all rights reserved. Dow Jones data © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. S&P data © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg Barclays data provided by Bloomberg. Treasury bills © Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). Charts from Dimensional Fund Advisors. Inflation is typically defined as the change in the non-seasonally adjusted, all-items Consumer Price Index (CPI) for all urban consumers. CPI data are available from the US Bureau of Labor Statistics. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. The indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. |