|

|

|

|

|

|

Easy as Pi

By Morgan Christen

CFA, CFP, CDFA, CEO and CIO

Welcome,

It was reported in August that a Swiss University broke the record for calculating Pi, taking it out 62.8 trillion digits. Here is the first one million digits.

Pi, or Archimedes' constant, is the ratio of a circle's circumference to its diameter. Approximately equal to 3.14159, Pi is considered an irrational number, as it cannot be expressed as a common fraction.

|

|

|

|

|

|

|

|

|

The Federal Reserve largesse has kept the economy sweet as pi(e). Massive amounts of liquidity have no doubt helped the economy and allowed the stock market to reach new heights.

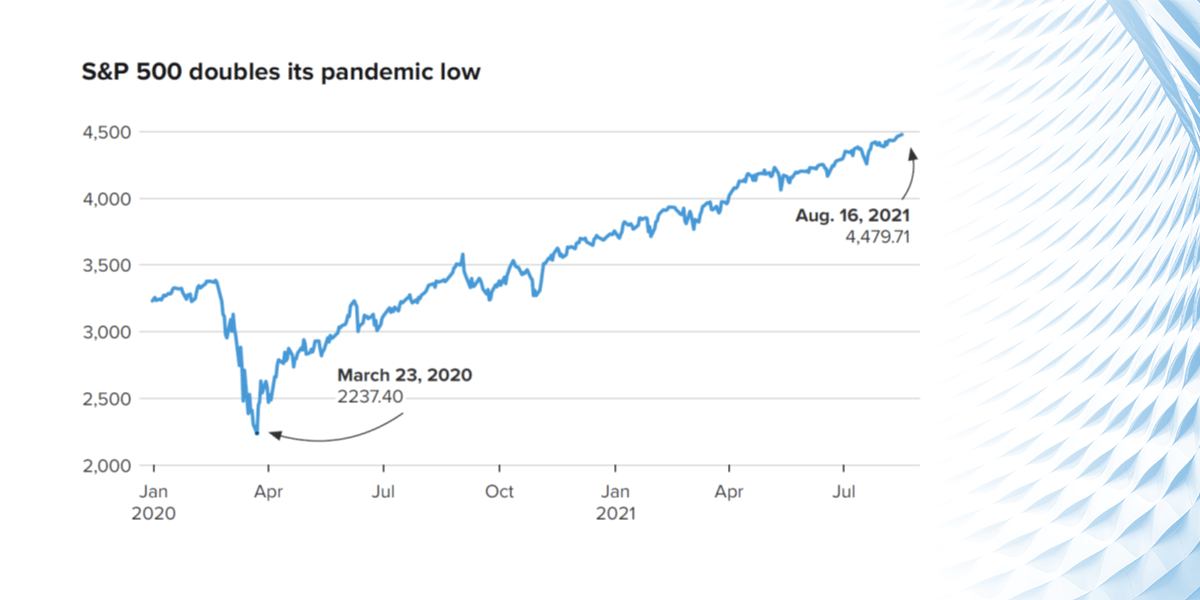

Case in point, as of August 16th, 2021, the market officially doubled from the lows of March 23, 2020. Historically, it takes much longer to double, but this time it only took 354 days.

|

|

|

|

|

|

|

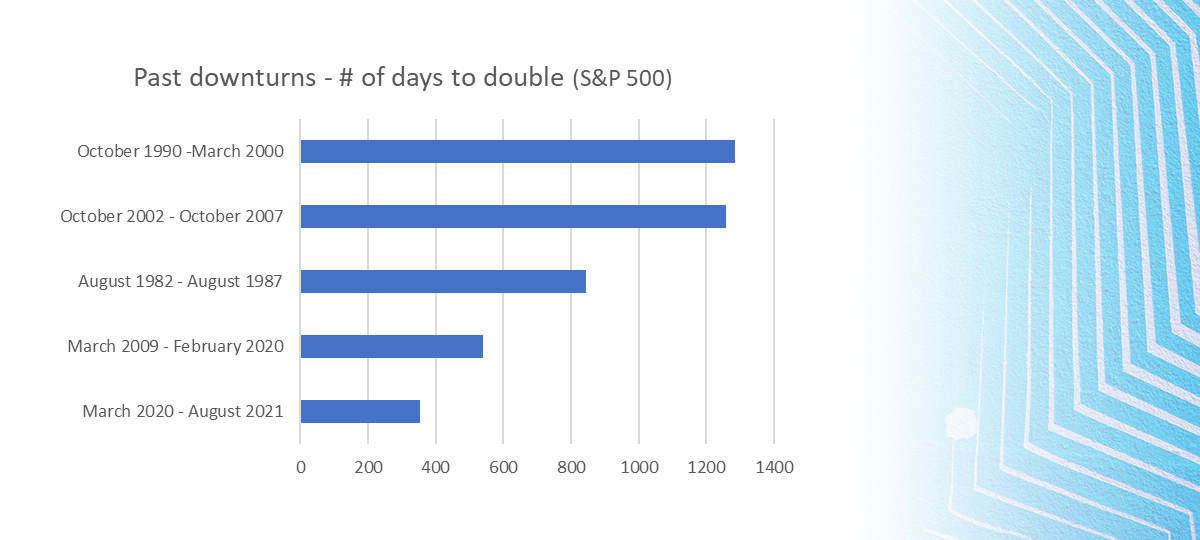

Prior downturns took much more time to recover as the federal reserve and Federal government were not as generous as they were for the Covid drop.

There is talk of Fed "tapering," but that does not mean they will be any less generous. The valuations should hold as the liquidity stays in the market.

Should rates begin to move up, we expect areas such as technology to feel the pain.

|

|

|

|

|

|

|

|

|

September Scaries

The month of September is not without issues. Geopolitically, the Afghanistan pullout has been disastrous.

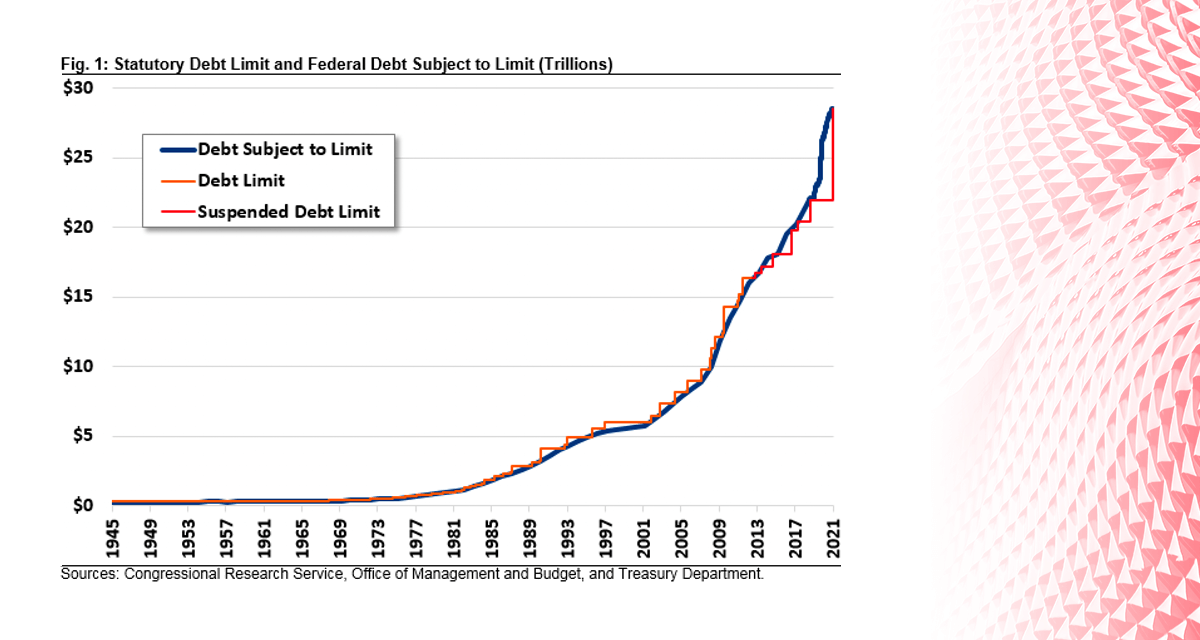

On the economic front, Congress will be having a debt ceiling showdown. Since the end of World War II, the ceiling has been modified nearly 100 times. No chance it won't happen again.

Additionally, the Fed will have their meeting at the end of the month along with the publishing of our GDP.

|

|

|

|

|

|

|

Inflation

We have stated before that we believe inflation will be transitory. The transitory inflation we are speaking of is the Consumer Price Index (CPI) as reported by the government.

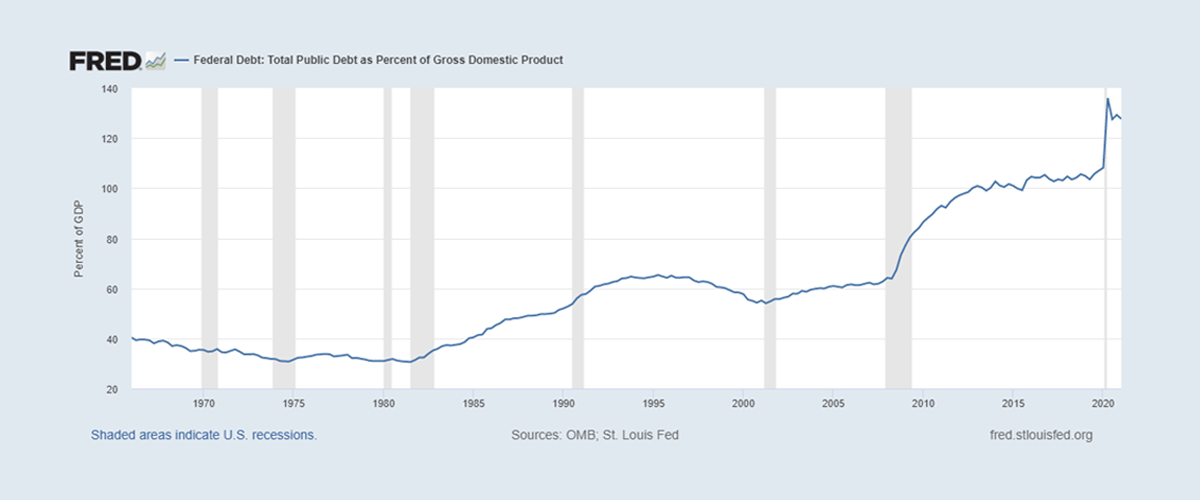

Real inflation is here, in fact, it has been here for a while. One thing that both political parties agree on: inflation is good. Why? Because it lessens our debt to GDP.

The chart above shows our debt to GDP. If you think we really started paying down our debt in the 70's, think again. But we did have a good amount of inflation in the 70's and the debt optics looked a lot better.

|

Our government is extremely happy to keep inflation above interest rates. Keep things inflating by keeping rates low; how else can they tame the debt monster?

Happy your $1 million home is now worth $1.2 million? You shouldn't be, you just lost 20% of your purchasing power. What has historically done well during inflation? Equities.

Real estate has historically returned roughly 3%, but stocks have exceeded that. That is not to say current increases in residential real estate are not impressive, but if your home appreciation is part of your financial plan, we need to talk.

|

|

|

|

|

Speaking of inflation and real estate. In Los Angeles, 2020 saw 159 homes sell for $10 million or more, so far in 2021 there have been 194. The range being $10 million to $68 million.

In Orange County, 2020 saw 44 homes $10 million or more, with 2021 already seeing 56. The range has been $10 million to $23 million.

Does it really take that much to build a house? Doubt it. This is inflation, ex se intellegitur. (it goes without saying).

|

|

|

|

|

Conclusion

Much like people will try to take Pi out to larger digits, our government continues to take our debt to an irrational number. A major concern for our Spinnaker clients is a loss of purchasing power.

Are there economic and geopolitical topics to watch? Sure. But your loss of purchasing power will have a deleterious effect on your financial freedom.

Will stocks be bumpy? Yes, for sure. There will always be headline risk and issues that may make investing sound bad. But we would opine that you have a good amount of risk in the long term - namely of being too safe.

|

|

|

|

|

|

Have You Taken

The SpinnCycle™?

A quick reality check for your portfolio

Enter the SpinnCycle and find your SpinnScore™

|

|

|

|

|

|

Spinnaker Mobile App now Available for IOS and Android

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2021 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. Debt Ceiling Orange County and Los Angeles County real estate data courtesy of Susie McKibben. Past downturn chart data from Yahoo Finance.

|

|