|

|

|

|

|

|

A little ditty about Jack and Diane...

By Morgan Christen

CFA, CFP, CDFA, MBA, CEO and CIO

Hello,

Wait, wrong ditty. This is a little ditty about Tina Smith, an individual trying to live the balanced life. Tina says 2020 sent her balanced life into a tailspin.

To have a balanced life she needed both internal and external balance. Internally she looked at her mind, heart, and health. Externally she looked at work, social, family and fun.

|

|

|

|

|

With this year, her internal balance was off as her mind was concerned and her health was in question. Externally, she was working from home, lacking social interactions and not having fun.

But life is a journey where one needs to find balance. As John Wooden once said, "next to love, balance is the most important thing."

|

|

|

|

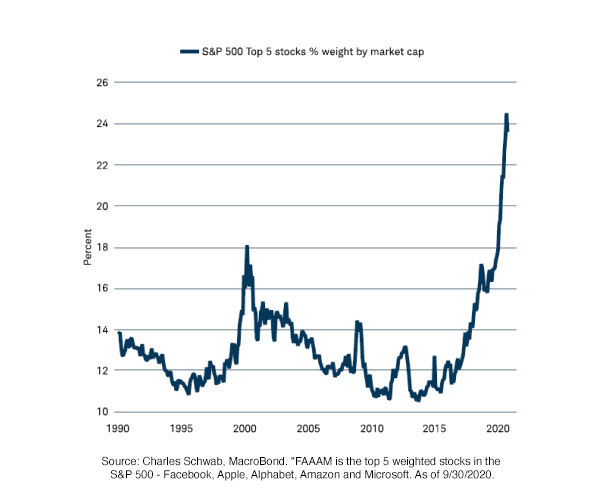

You may have heard us talk about TINA SMITH (There Is No Alternative So Marry Into Tech Hedonism) in context to investor preferences. TINA SMITH is a parallel to investing in 2020. TINA is a force that has led investors out of cash and into stocks. SMITH has led five tech stocks to dominate this market.

|

Just like Tina cannot overdo fun and social interactions over her health and career, investors cannot overdo the hot sector to the detriment of their financial balance. It is enjoyable to have a ton of fun and do what others are doing, but you never want to be last at the party.

|

|

|

|

|

|

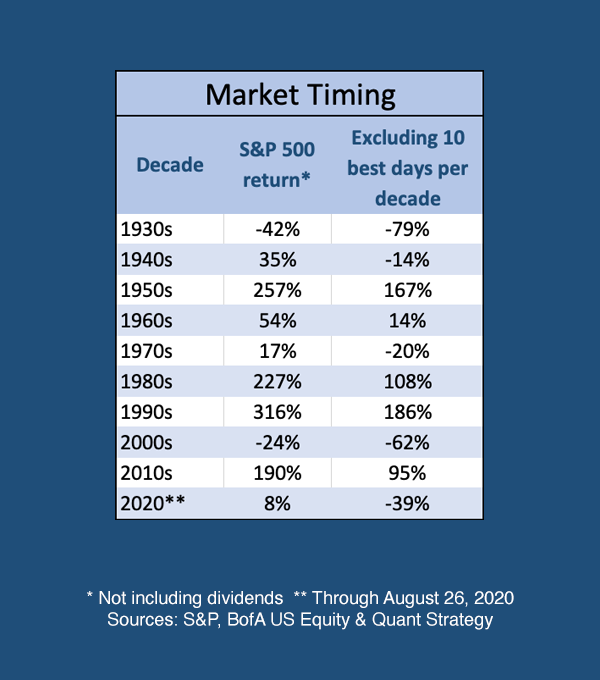

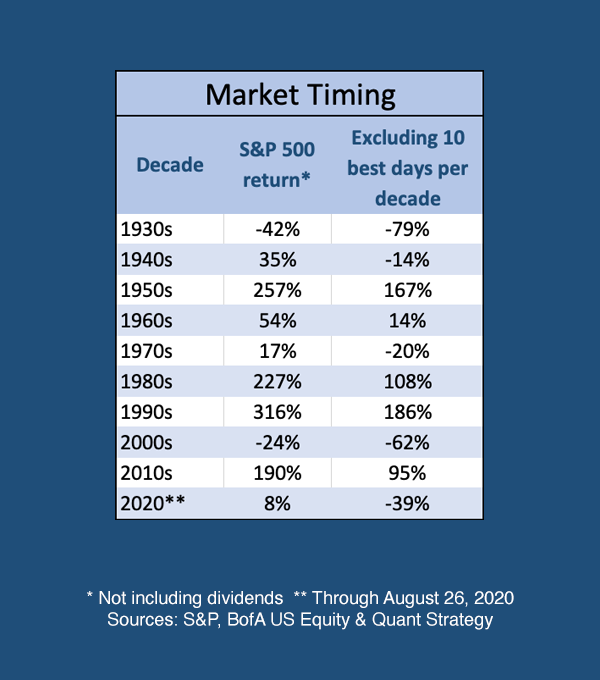

To find financial independence, investors should at least show up at the party. As the famous proverb states, "all work and no play make Jack a dull boy."

Having fun is a part of both life and financial balance.

|

As the chart shows, those that declined the invitation and sat home fared worse than those in attendance. We will always have disruptors in investing and trying to time the market does not work. Balancing your risk and accepting volatility is a better method for success.

|

|

|

|

|

Tina struggles to get the balance in life and rumor has it she has eyes for Mr. ABBOT (All But Big Ostentatious Tech). Mr. Smith is a good earner, but he is expensive. Tina is worried Mr. Smith is going to live beyond his means. What Mr. Smith lacks in balance, Mr. Abbot has in spades.

Tina is not leaving Mr. Smith right now, but the friction could cause a break at some point. Tina really cares for Mr. Smith and for good reason, so he will always be a part of her life, albeit a smaller part going forward.

|

|

|

|

|

Conclusion

Allocating capital for investors is a balancing act. Of course, there are stories about someone who is crushing the market, generally in the short term. But much like leading a balanced life, you need a balanced approach to investing.

Cash is not a great alternative; nor is timing or an overallocation to one sector. Balance in life and investing is not easy; there is no set instructions as we all are different. Priorities change, goals change, and we change. We take your balance seriously and balance tends to lead to success.

Oh, let it rock, let it roll.

|

|

|

|

|

|

Have You Taken

The SpinnCycle™?

A quick reality check for your portfolio

Enter the SpinnCycle and find your SpinnScore™

|

|

|

|

|

|

Spinnaker Mobile App now Available for IOS and Android

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2020 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio The S&P 500 Index is a free-float market capitalization weighted index of 500 of the largest US companies. This index is calculated on a total return basis with dividends reinvested and is not available for direct investment. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. The indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. The 7 Key Elements of A Balanced Life - Madolyn - Balanced Life.

|

|