| CONNECT |

|

My four speed, dual-quad, positraction 409

My four speed, dual-quad, positraction 409

By Morgan Christen CFA, CFP, CDFA, MBA, CEO and CIO Welcome, This lockdown has turned us into connoisseurs of all types of shows and documentaries. I have learned about a Tiger King, a cult in Oregon, and heard a few death row confessions. When I want a quick escape from the news and the incessant bad reports thrown at me, I tend to watch shows about cars (much to my wife's chagrin). Whether they are reviewing them or fixing them, watching someone find an old car in a barn and get it running fascinates me. Taking a vehicle with nests in it, years of dirt and dust, and getting it running requires a process to get the car cranking over. That process begins with checking for spark, cleaning the carburetor, change oil and filter, fresh gas and some pre-lubing. Turn the key and let us see if she starts. |

|

|

Many economists are talking about our economy in terms of restarting an old engine, and I would agree. Much like these cars, the economy will take a bit to get started.

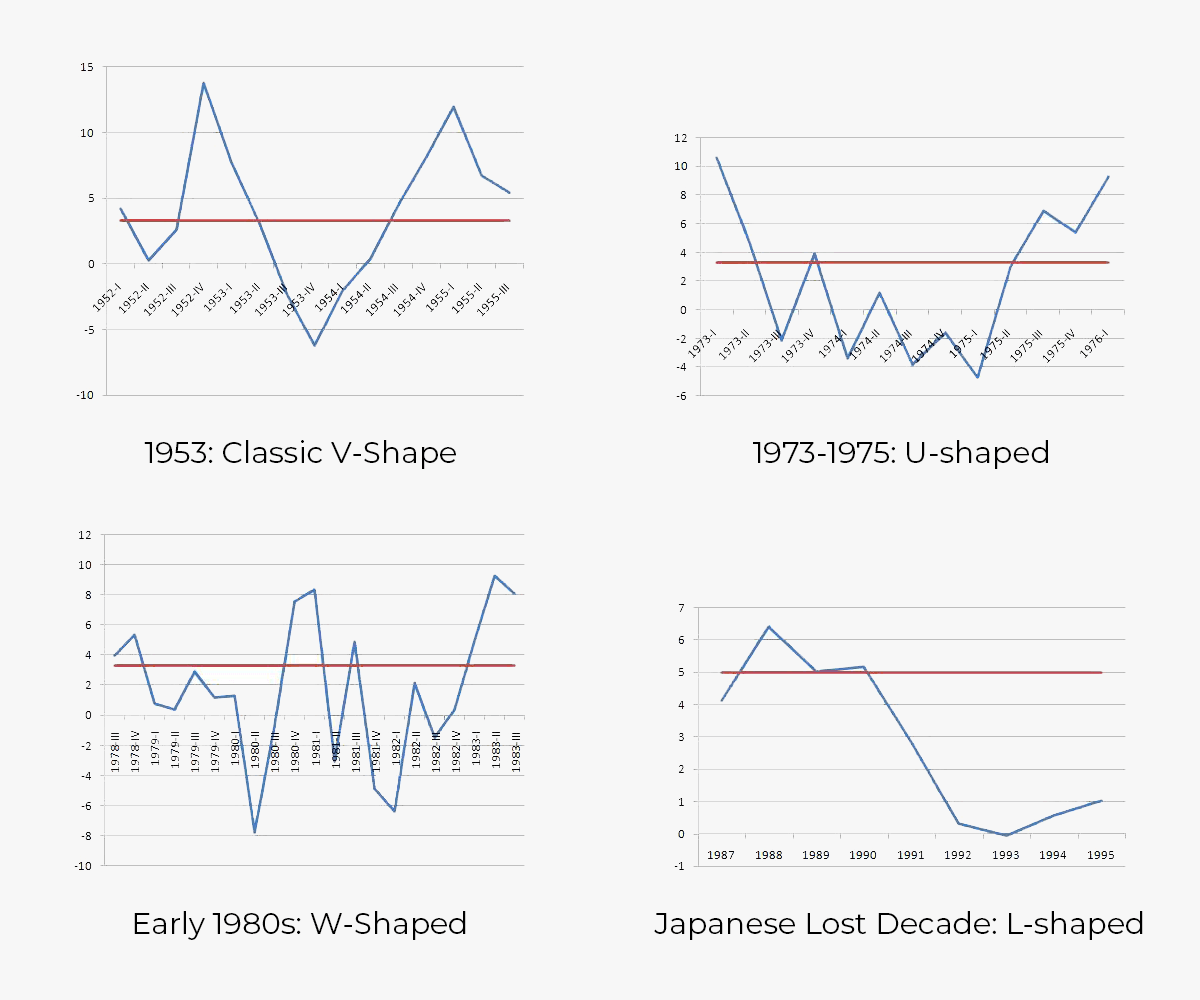

Will people go back to stores and restaurants immediately? Will consumers spend? Will they be the spark? Will companies start ramping up travel? We know the Fed is providing a tremendous amount of lube to the economy, which should help once the engine starts to turn. However, once it starts, we are not sure if there is the capacity to put the hammer down. This economy may be a 1972 Volkswagen bug rather than my four speed, dual quad, posi-traction 409. There has been a lot of talk about the economy coming back in a U-, V-, W- or L-shaped recovery. The outcome of this alphabet soup could vary vastly. The ideal outcome is the "V" shape, showing a strong recovery that will not only make the numbers look good for 2021, but also a better 2020. The worst outcome being the "L" shaped recovery, much like Japan saw during their lost decade. We would suggest this recovery will be more like a Nike "swoosh" recovery. Much like the "U" shape but a longer trough. |

As we start to phase in this economy, it will be interesting to see who goes back to work and who shows up at restaurants, bars, and gyms.

A "V" shaped recovery assumes that people start to flood into restaurants and other venues, which may not be the case. It may take people time before they venture back to restaurants, some polls show that 81% of Americans want to wait until it is "safe." The swoosh is more appropriate in our view, as it will first take time to get the motor running and then take a little more time before we can put the pedal to the metal. The economy, and our lives, will never go back to the prior "normal." Employees seem to be productive not working in an office. People will start to save a bit more, as they realized they did not have enough in the bank. We are walking more, does that mean traditional gyms will be a thing of the past? A new normal is fine. We will learn better and different ways to do things, many of which will lead to a much higher quality of life. We are starting to see changes in societal and economic values, and those appear to be positive. |

|

|

|

THAT INCLUDES

People who have been furloughed aka when your company hits pause on your job and your paycheck, until it can (hopefully) hire you back later. People who work for companies that have temporarily stopped operations because of the virus. People who are quarantined and expect to go back to work afterward. You may have to show proof that you were mandated to quarantine by a health professional. |

People who leave their job because they are at risk of being infected at work.

And people who leave work because they are infected or taking care of an infected family member. Freelancers, people who are self-employed, and gig workers - like Uber drivers - can also now apply for unemployment benefits. If you have multiple jobs and lose one, some states allow you to file. |

|

|

|

|

|

Announcing:

The SpinnCycle™ A quick reality check for your portfolio Enter the SpinnCycle and find your SpinnScore™ |

|

| Spinnaker Mobile App now Available for IOS and Android |

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence. © 2020 Spinnaker Investment Group. All Rights Reserved. Disclosures |

GET IN TOUCH

949.396.6700 info@spinninvest.com spinninvest.com 4100 MacArthur Blvd., Ste 120 Newport Beach, CA 92660 |

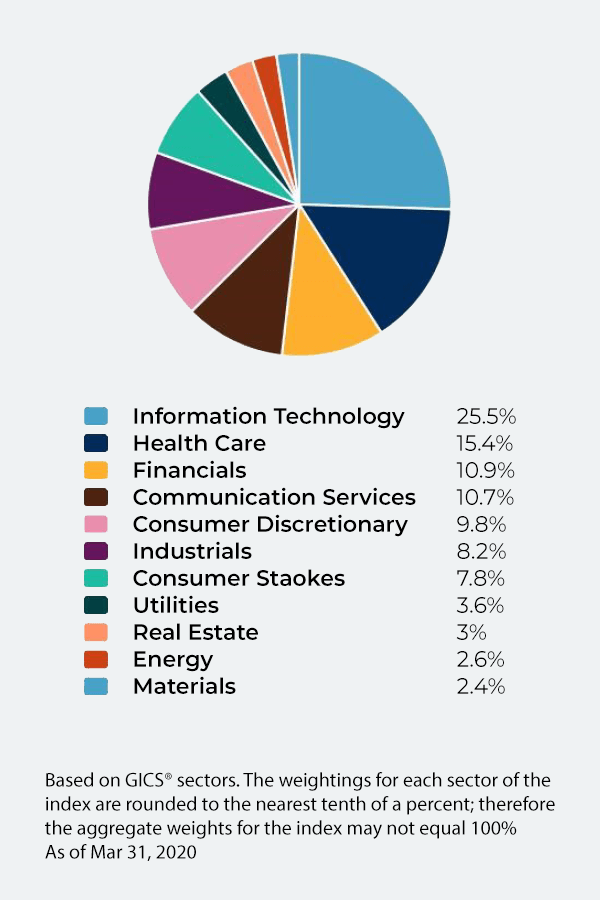

| DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. The S&P 500 Index is a free-float market capitalization weighted index of 500 of the largest US companies. This index is calculated on a total return basis with dividends reinvested and is not available for direct investment Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. Recovery charts courtesy of Wikipedia. 409 lyrics from Beach Boys and Brian Wilson. |

Conclusion

Conclusion