|

|

|

|

|

|

MORGAN'S CORNER

By Morgan Christen

CFA, CFP, CDFA, MBA, CEO and CIO

Welcome,

A certain Latin term has been prevalent on the news over the last few weeks. In fact, that term was "googled" over two million times. A few weeks ago, I heard Charles Schwab (the actual Chuck) talk and it reminded me of another Latin term, 'vestri optimus interest,' which means 'your best interest.'

|

|

|

|

|

|

Chuck started Charles Schwab and Company to help the little guy: Main Street versus Wall Street. He wanted a brokerage firm with low barriers to entry, low costs, and he would not pay his brokers a commission. He felt that earning a commission misaligned the interests of the investor and broker.

|

|

|

Stocks

The last month saw the market move ahead with the hope of the China "phase one" trade deal getting completed, better-than-expected payroll numbers, good housing data and the Fed lowering rates in October. Let's start with the trade deal: Far from complete, investors still hang on the hope of a completion, and a deal not fait accompli. Of more concern is "phase two" - the meat of the deal. Missing from phase one are items such as intellectual property theft, technological transfers and supply chains. Phase two, we assume, will be more difficult to complete.

|

Jobs & Spending

Investors have tuned in to the jobs report, as any weakness would reverberate to the consumer and their spending habits. Job creation was strong as labor force participation rose. The market was happy to see more people entering the job market and pushing up the participation rate. While the consumer is working, they are showing signs of frugality. Recently reported earnings at Home Depot and Kohls showed weakness, while discounters such as Wal Mart, Target and TJX (TJ Maxx, Marshalls and Home Goods) showed strength. The consumer is continuing to spend, but they are looking at alternatives to stretch their dollar.

|

|

And?

What could slow this rally? Business capital expenditures continue to weaken, leaving economic growth on the back of the consumer -- a consumer who is taking out longer car loans and shopping for bargains. The Fed is still accommodative, and rates remain low, but as Ned Davis Research notes, the Presidential election cycle suggests bumpiness ahead.

|

|

|

|

Tip of the Hat

We are often asked why we chose Schwab to custody your assets. There are many reasons including low costs, size and technology. But it is also what Chuck built and after hearing him speak, my faith in him and his eponymous firm has been reaffirmed. Chuck wanted a world where investors would get a fair chance at making a buck. A place where incentives were aligned with the client. He believed that a traditional broker was trying to take your capital and turn it into their income as soon as possible.

Spinnaker was built on the principles of treating our clients fairly and in a fiduciary manner. We charge a fee for our service, there is no incentive to push product on our clients. I think the following quote from Chuck, sums up our belief.

|

|

|

"Three men were laying brick. The first was asked: What are you doing? He answered: Laying some brick. The second man was asked: What are you working for? He answered five dollars a day. The third man was asked: What are you doing? He answered: I am helping build a great cathedral.

Which are you?"

|

|

|

As 2019 approaches the end, we are the third; we are looking forward to continuing to build your cathedrals. Our commitment to our clients will always lead our every decision.

We hope that you have a great holiday season and try to tune out the noise. There are a lot of distractions, and as another Charles (Charles Schultz) once said, "don't worry about the world coming to an end today. It is already tomorrow in Australia."

|

|

|

|

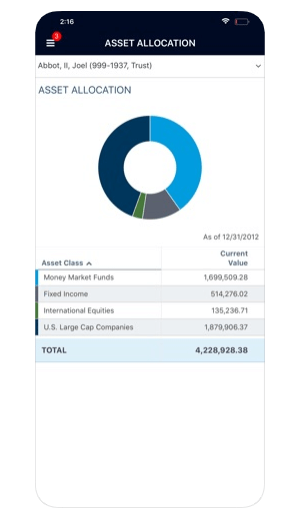

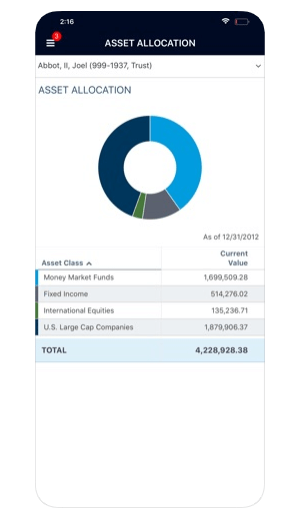

Mobile App now Available for IOS and Android

We started Spinnaker with a focus on our clients, aiming to provide the best possible service and client experience. Following on the investment in our client portal, we have launched the Spinnaker Client Mobile App. Available for both IOS and Android, this dynamic app provides a detailed report of each client's portfolio based on the prior market day's closing and shows allocations, rate of return overall, and ROR per asset since inception.

|

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2019 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio The S&P 500 Index is a free-float market capitalization weighted index of 500 of the largest US companies. This index is calculated on a total return basis with dividends reinvested and is not available for direct investment. CPI data are available from the US Bureau of Labor Statistics. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice.

|

|