|

|

|

|

|

|

MORGAN'S CORNER

By Morgan Christen

CFA, CFP, CDFA, MBA, CEO and CIO

Welcome,

Fall is here, football is back, and we now move to the final quarter of 2019. Much like the game of football, the fourth quarter is when losing and winning will be determined. To date the market is leading, but will it blow the lead like the Cleveland Browns of the past?

|

|

|

|

|

Sometimes there is a "Santa Claus" rally and sometimes the Steel Curtain pushes you back behind the line of scrimmage.

Historically, the fourth quarter is a good time for the market.

Over the last 31 years we have had 6 negative and 25 positive fourth quarters in the S&P 500, which is an 80% positive rate.

|

|

|

Quarter in Review

We enter the fourth quarter with a mixed economic picture, as manufacturing is weakening while the consumer and services remain strong. Trade tensions are still a roadblock as the new NAFTA, the United States-Mexico-Canada Agreement (USMCA) awaits Congressional approval. The US/China tariff dispute may not see an end until sometime in 2020. Corporations have retreated in their capital spending as they wait for a conclusion in the trade war.

More individuals have been fearing a recession as Google reports the search volume for "recession" hit highs last seen in 2009. Consumer confidence is still strong, but we continue to watch for signs of weakening. With the consumer being such a large part of the economy, any weakness could push us closer to a recession. On a positive note, interest rates remain low and could go lower, inflation is low and the Fed has become accommodative. All good signs for the markets. Many economists are viewing our economy as an airplane. Currently we are flying on one engine, the consumer. Our economic speed would be described as stall speed, which is the slowest a plane can fly while still maintaining a level flight.

|

|

|

|

Stocks

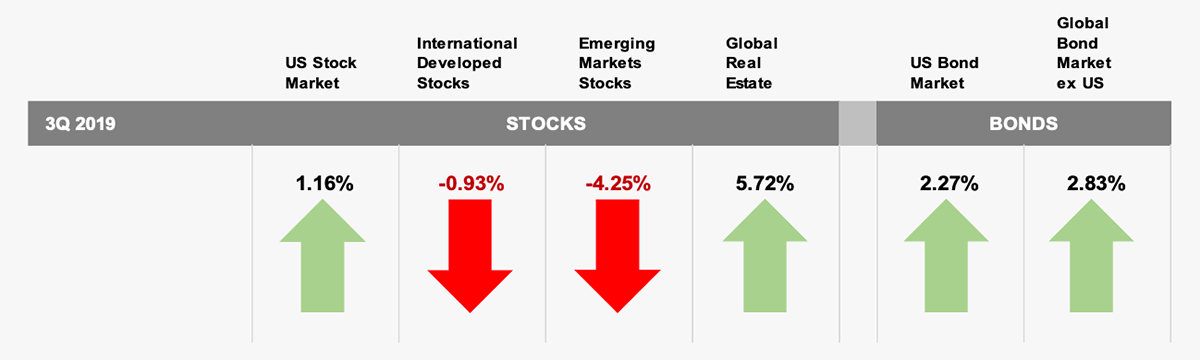

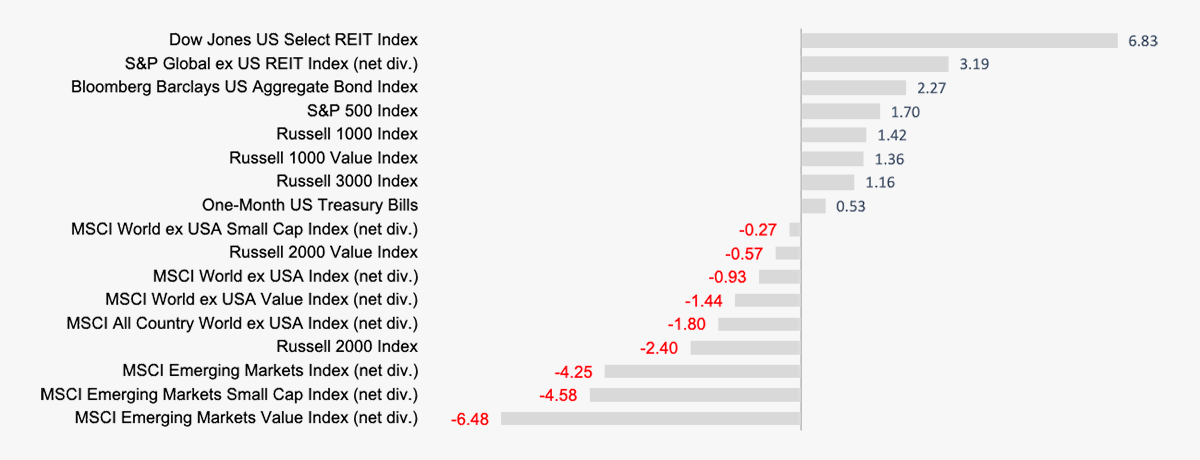

US equities outperformed both the international and emerging stock markets. Large companies fared markedly better than smaller companies in the US and international markets. Slowing international and emerging economies continue to weigh on their performance. REITs performed well, as they tend to move up as interest rates move down. We believe large US companies will continue to look attractive compared to their international, emerging and smaller counterparts.

|

|

|

|

Bonds

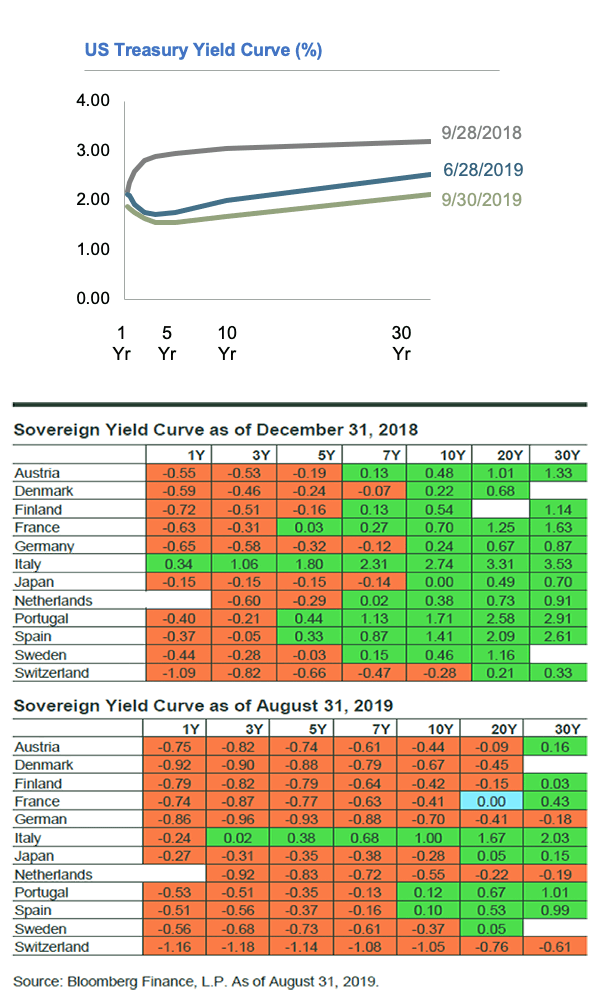

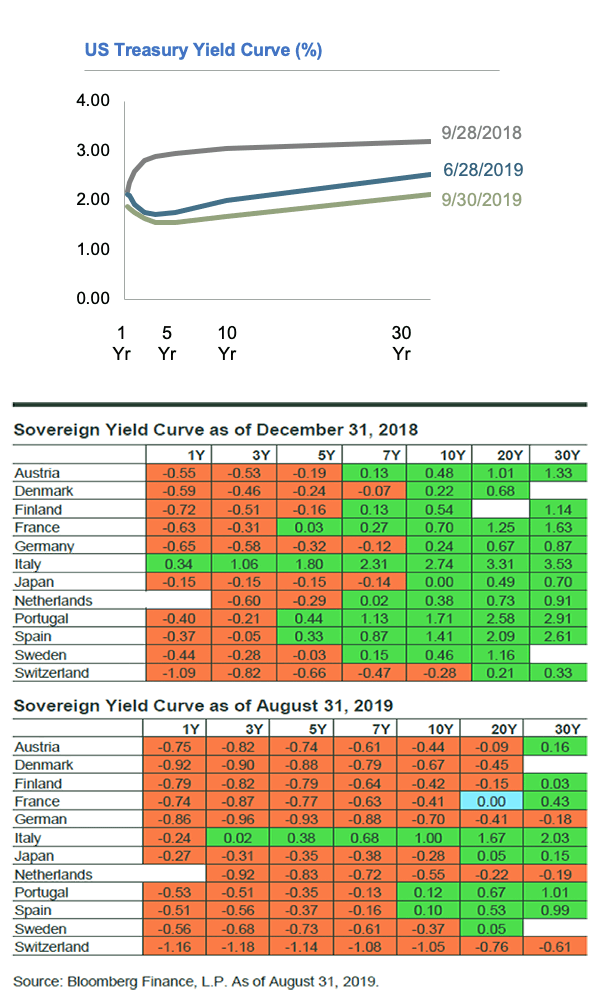

Interest rates in the US Treasury markets decreased during the third quarter. As noted in the yield curve chart, rates fell at all maturities versus the second quarter.

As low as our rates appear in the US, they are still higher than most sovereign debt.

As shown in the sovereign debt chart, many countries have negative yields, in fact the rate of negative yielding debt expanded from the start of the year. While we do not believe the US will have negative yields, there are certainly arguments that rates in the US could go lower.

We should see a reduction of a quarter point in the Fed Funds Rate later this month.

|

|

|

|

Now What

Stall speed seems to be the scenario moving forward. Growth appears to be weak to flat with the consumer continuing to move the economy forward. Pending elections could see fiscal and monetary stimulus. Consumer sentiment will be on the mind of the market as trade issues, higher energy prices, and slowing international markets could turn off the consumer. Trade deals would be a positive for the market, as that could help international markets and possibly bump start manufacturing. Bond rates should remain low and inflation should be in check.

We look forward to speaking with you over the next couple of weeks. We have had many great client conversations about markets and the economy, some of which triggered adjustments in portfolios. Our advisors are always available to discuss your goals for today and the future.

|

|

|

|

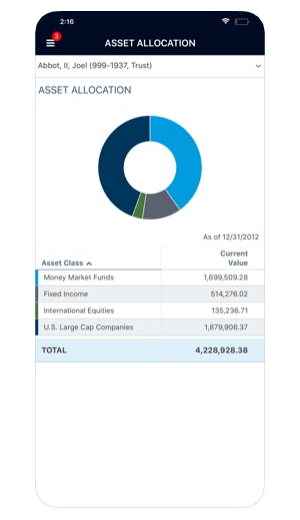

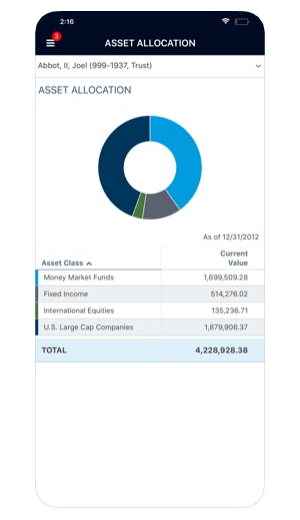

Mobile App now Available for IOS and Android

We started Spinnaker with a focus on our clients, aiming to provide the best possible service and client experience. Following on the investment in our client portal, we have launched the Spinnaker Client Mobile App. Available for both IOS and Android, this dynamic app provides a detailed report of each client's portfolio based on the prior market day's closing and shows allocations, rate of return overall, and ROR per asset since inception.

|

|

|

|

|

|

Spinnaker Again Named one of OC's Fastest Growing

Spinnaker Again Named one of OC's Fastest Growing

For the second straight year, the Orange County Business Journal ranked Spinnaker Investment Group, LLC among Orange County's fastest-growing private companies. The firm was recognized at number 17 on the publication's list out of 36 companies ranked in the small business category. The Orange County Business Journal publishes a "Fastest Growing Private Companies" report in mid-September annually as part of its weekly list series.

|

|

|

|

|

|

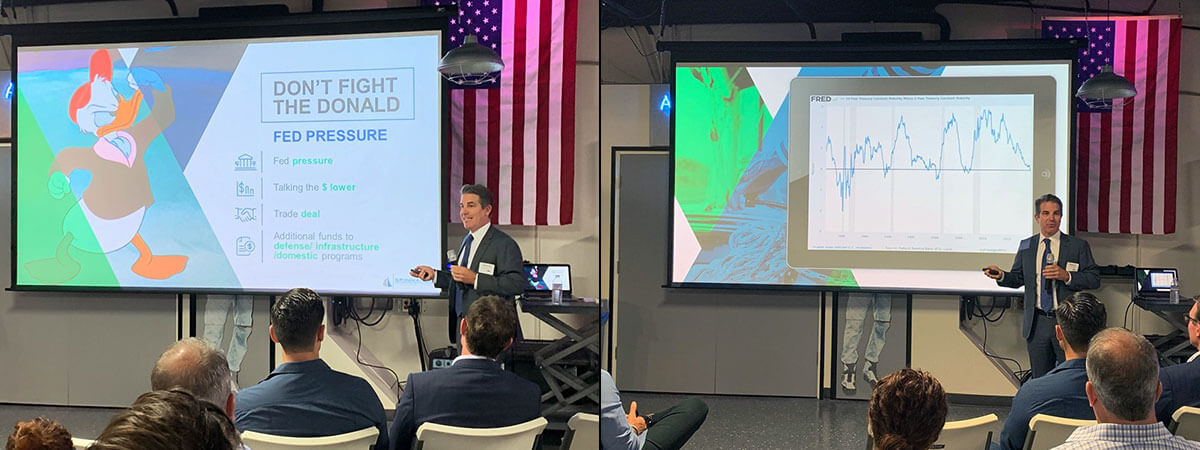

Spinnaker presents 2020 Economic Outlook at September IEC meeting

Morgan Christen joined OCTANe CEO Bill Carpou in September to provide International Executive Council (IEC) members a detailed look at the key drivers of our region's economic growth, the markets, and the outlook for our economy in 2020. More than 40 key Southern California business leaders attended the event graciously hosted by Al Hensling of United American Mortgage Corp.

|

|

|

|

Krongold Named One of 40 Under 40 by Irvine Chamber

Spinnaker's Andrew Krongold will be awarded this month by the Irvine Chamber of Commerce, named as one of 40 professionals under the age of 40 who are making strides in their industries and the business community in Orange County. Congratulations, Andrew!

|

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2019 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2019, all rights reserved. Bloomberg Barclays data provided by Bloomberg. The S&P 500 Index is a free-float market capitalization weighted index of 500 of the largest US companies. This index is calculated on a total return basis with dividends reinvested and is not available for direct investment. Charts from Dimensional Fund Advisors. Inflation is typically defined as the change in the non-seasonally adjusted, all-items Consumer Price Index (CPI) for all urban consumers. CPI data are available from the US Bureau of Labor Statistics. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. The indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice.

|

|

Spinnaker Again Named one of OC's Fastest Growing

Spinnaker Again Named one of OC's Fastest Growing