|

|

CONNECT

|

|

|

|

|

|

|

|

|

MORGAN'S CORNER

By Morgan Christen

CFA, CFP, CDFA, MBA, CEO and CIO

Welcome,

The Rolling Stones's "Time Waits For No One" was featured on their 1974 album, "It's Only Rock 'n' Roll." The Stones, perhaps realizing their audience and that time waits for no one, chose as their sole 2019 tour sponsor, a non-profit organization that aims to encourage people to think about retirement finances.

|

|

|

|

|

Time Waits

For No One

Wait, what? When a band, still touring, with members in their seventies, is talking about financial independence, maybe we should take notice.

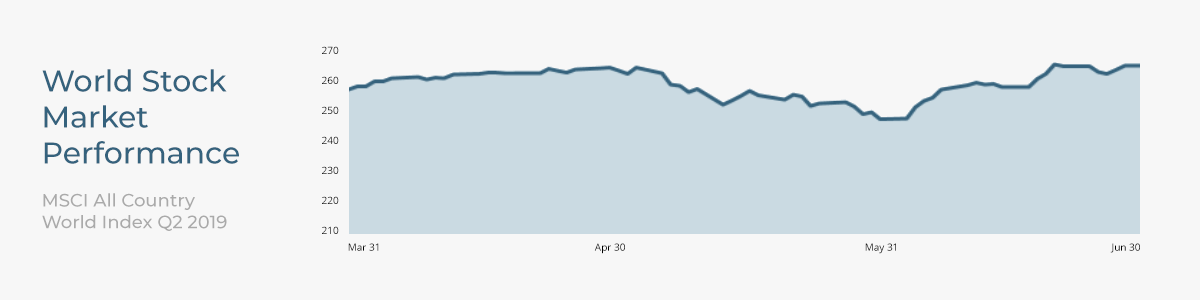

All things being equal, lack of time can lead to a lack of independence. The prior quarter was an interesting time with a positive outcome, mainly due to the Federal Reserve. The Fed has hinted they may cut interest rates this year, and that was cheered by investors. But the quarter was not all rosy, as May was a tough month and investors continued to pull money out of stock funds.

Those who know time is on their side held steady and were rewarded. Professional boxer Bernard Hopkins was credited with saying, "I don't react and think off emotions - that gets you in a bad situation." Reacting in May would have altered the course of an investor's year.

|

|

|

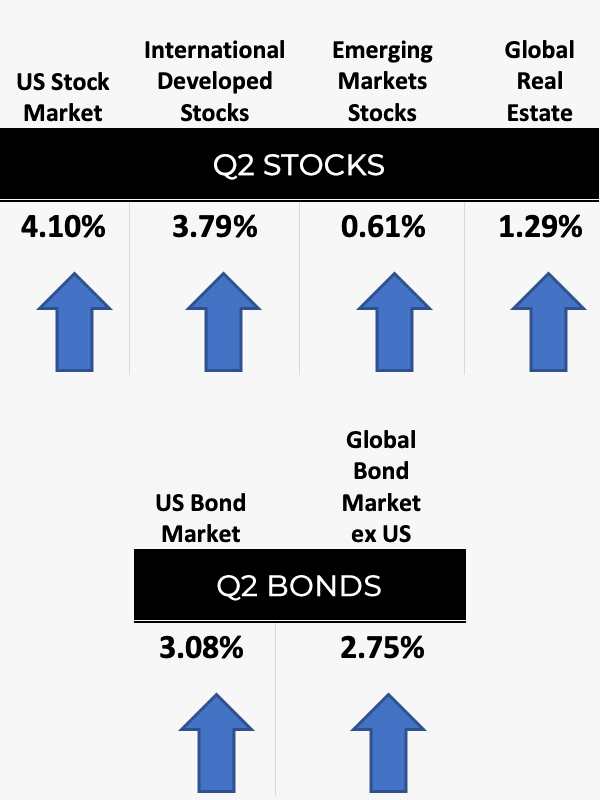

Markets

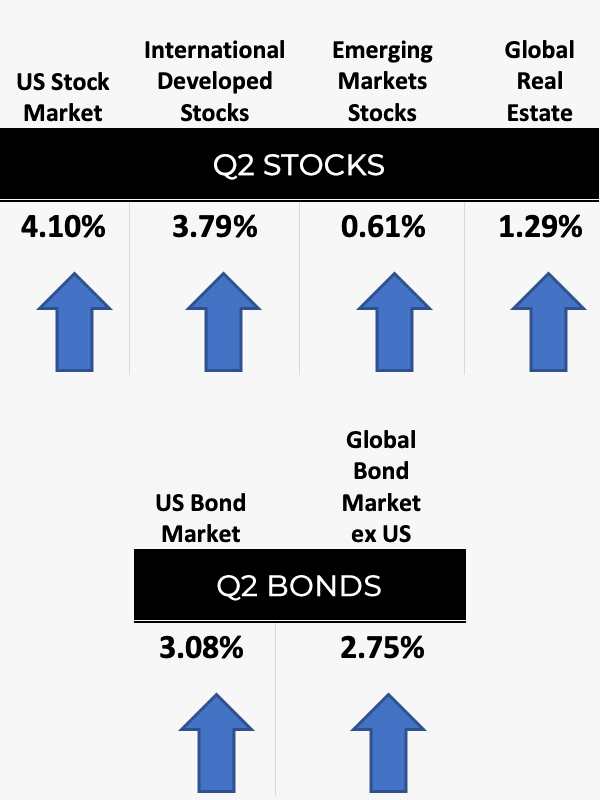

The US markets led the quarter, outperforming both the international and emerging markets. With interest rates falling, bonds performed well also. Smaller companies outperformed large companies in the US and value stocks underperformed growth.

Commodities were mostly down with oil and materials off; natural gas led the decline with a negative 16.67%. The positives in commodities were in the food products with corn up 14.24%.

|

|

|

|

|

|

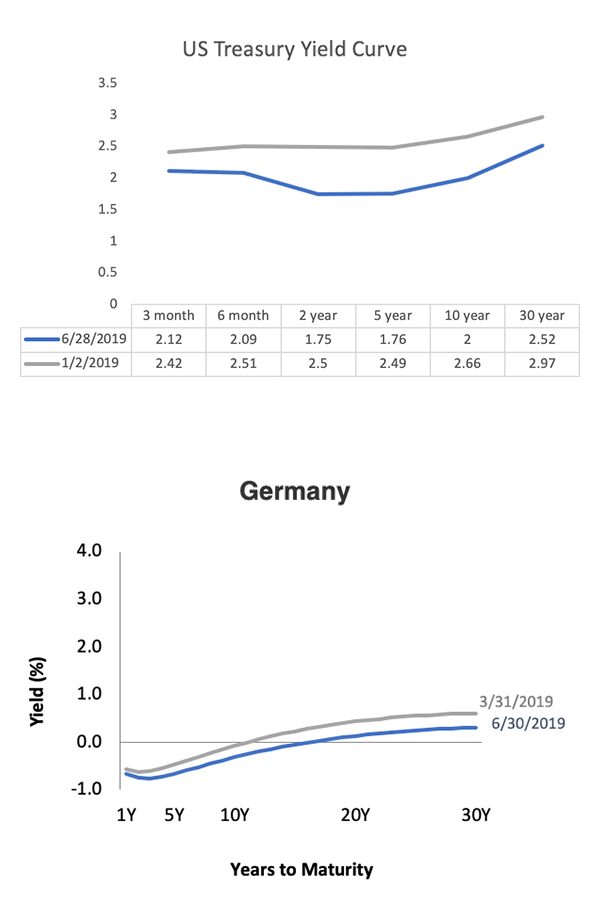

Fixed Income

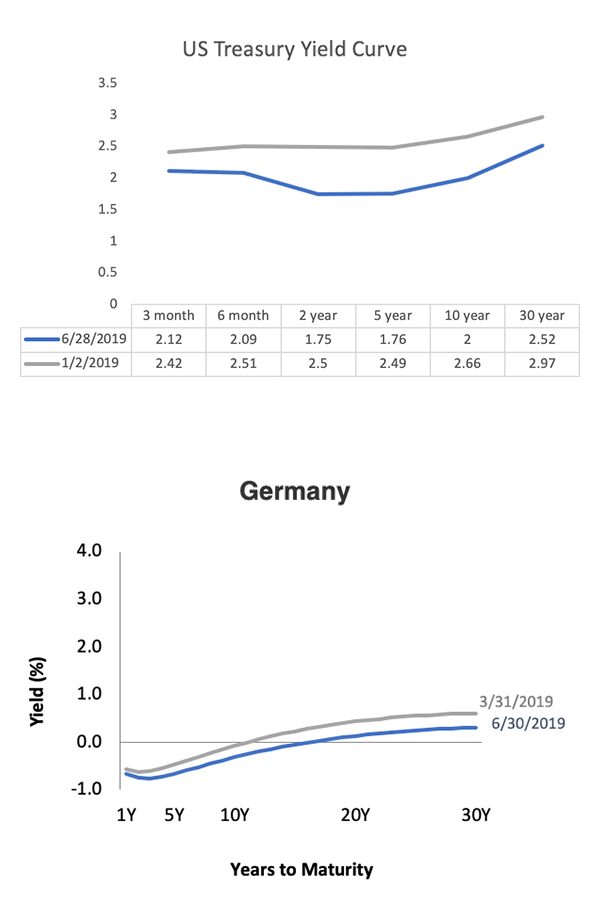

Interest rates have made a dramatic move from the first of the year. The "belly" of the curve making the biggest moves with six-month, two-year, five-year and ten-year lower than the three-month. That scenario is what they call an inverted yield curve, meaning investors do not want to invest their funds over the long term, preferring a quick return of capital.

There are other factors at work on this curve, such as foreign purchases of our debt. The US Department of Treasury reported that 40% of our debt is foreign owned. As of the end of June, Germany had negative interest rates. So as low as we are, our treasuries are still attractive to foreign countries.

|

|

|

|

|

Speaking of Independence

(or loss of)

Please join us in congratulating Spinnaker Vice President, Andrew Krongold. Andrew and his beautiful wife Brittney were married in Cabo San Lucas in June. The Spinnaker team, not wanting to miss a party, jumped on a plane to help them celebrate their nuptials.

|

|

|

Now What

For many of our clients, we put a plan in place a long time ago. We hope you enjoy your financial freedom tour, working because you like to and not because you need to. Markets will continue to gyrate as tariff and interest rate talks continue. But, let time be your friend and those fluctuations will level.

I still enjoy seeing bands like the Stones on tour. I often wonder what would have happened if a Spinnaker Adviser got a hold of them years ago. Our goal is to keep our clients from wearing leather pants and denim vests on their freedom tour.

With the quarter ending, we hope to be speaking with you all soon.

|

|

|

|

Lynn Selich Named Director Of Business Development

Please help us welcome Lynn Selich to the Spinnaker team! As Director of Business Development, she will develop and manage new and existing client relationships, identify strategic alliance opportunities in the marketplace, as well as advance marketing and public relations initiatives and outreach. To reach Lynn, please call (949) 396-6705 or email her at lynn@spinninvest.com.

|

|

|

|

|

|

|

|

June Open House:

A Toast To Our Clients & Continued Growth

Spinnaker Investment Group recently opened our new headquarters to more than 140 clients, guests and elected officials. The firm has steadily added clients and named additional investment advisors, driving our expansion to new offices.

The Koll Center Newport business complex provides Spinnaker an excellent ground-floor location in an integrated campus, with amenities that further enhance the client experience we strive to offer.

Guests attending the Open House included Newport Beach Mayor Pro-Tem Will O'Neill, past Newport Beach Mayor Rush Hill, Newport Beach Chamber of Commerce President Steve Rosansky and Craig Properties CEO Steve Craig.

Thank you to our clients who joined us to celebrate!

|

Spinnaker In The News

Our HQ move was covered recently by a variety of news organizations, including the Orange County Business Journal, Orange County Register, Stu News Newport, and FinTec Buzz.

|

|

|

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2019 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2019, all rights reserved. Bloomberg Barclays data provided by Bloomberg. Graph Source: MSCI ACWI Index [net div.]. MSCI data © MSCI 2019, all rights reserved. It is not possible to invest directly in an index. Performance does not reflect the expenses associated with management of an actual portfolio. Past performance is not a guarantee of future results. Commodities returns represent the return of the Bloomberg Commodity Total Return Index. Individual commodities are sub-index values of the Bloomberg Commodity Total Return Index. Data provided by Bloomberg Yield curve data from Federal Reserve Source: ICE BofAML government yield. ICE BofAML index data © 2019 ICE Data Indices, LLC Charts from Dimensional Fund Advisors. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice.

|

|