|

|

Welcome,

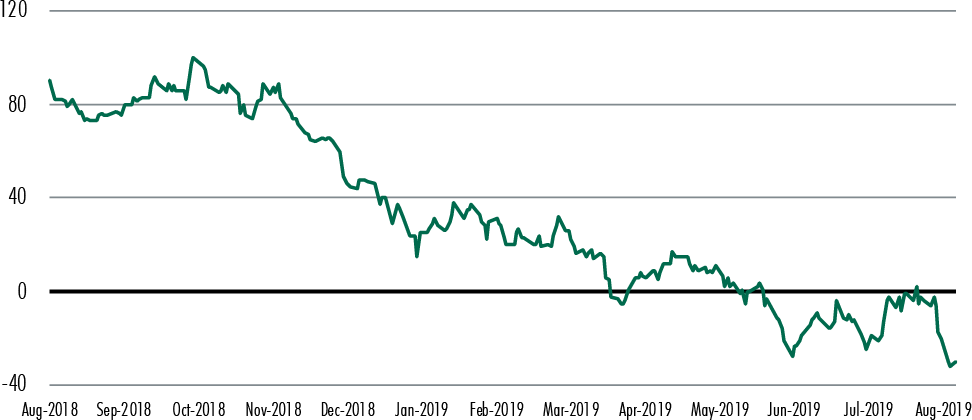

Much attention has been focused on the yield curve as an indicator of a recession and perhaps with good reason. Historically, an inverted yield curve has preceded, by six months to two years, every significant downturn in the economy since the middle of the 20th century. However, it should be noted that not every occurrence of such an inversion has resulted in a recession. More pointedly, what does it mean for this economy, and what does it mean for real estate investing? Current Conditions Beginning back in December 2018, yield curves began inverting. Then, it was the five-year note versus the three-year note, which was followed in March 2019 when the yield on the 10-year note dipped slightly below that on the three-month bill. Now, in August, we've seen: • The 10-year yield fall below the 1-year yield • The 10-year yield fall below the 2-year yield • The 30-year bond close below 2% for the first time in history |

Current Economy

Source: Federal Reserve Bank of St. Louis. CBRE Research, Q3 2019 |

|

Despite trade uncertainty, primarily with China, and struggling economies abroad, notably Germany, the U.S. economy remains strong. Many commentators see positive signs. Economic growth continues at a respectable rate, unemployment remains low and jobs continue to be added and consumer spending is robust. Additionally, the Fed's willingness to lower interest rates is taken by many as a sign that it will not allow the economy to experience a severe recession.

General Considerations When stocks are reacting with volatility to world events and bond yields sinking, real estate should receive investors' attention. Historically, real estate shows little correlation with the equity and debt markets, and due to the tendency to view real estate more as a long term investment, it is uniquely positioned to better weather economic downturns. On the other hand, REITs are more likely to correlate with equities when a recession looms, especially in the short term. However, REITs do offer some diversity as an alternative to stocks and bonds, they have the advantage over privately held real estate in terms of liquidity and they do tend to perform better than equities if held over a long term. The bottom line is Primior has the experience and knowledge, along with a proven track record, to succeed in any type of market. Contact us today to review your investment needs.

Best Regards,

Johnney Zhang Founder & CEO, Primior |

|

800.735.9973 info@primior.com |

LATEST TWEET

Interested in what the four best practices behind asset management are? Check out our latest blog and discover how... https://t.co/xV9Dxd0Po5 |

| © 2019 Primior. All Rights Reserved. |